| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||

|---|---|---|---|---|---|---|

| 2025-10-02 |

EventLink

Marketing Sterling Heights, Michigan www.eventlinkgroup.com EventLink is a provider of experiential marketing services and has built a reputation for creating and executing some of the most logistically challenging marketing events in North America. EventLink was founded in 2009 and is based in Sterling Heights, Michigan. Advisors: Kirkland & Ellis , BrightTower |

Secondary Buyout |

Serata Capital Partners

Paceline Equity Partners

|

Fort Point Capital

|

||

| Deal Article Deal Link | ||||||

| 2025-10-02 |

Charter Industries

Building Materials Kentwood, Michigan www.charterindustries.com Charter Industries is a supplier of PVC and wood edgebanding, T-molding and veneer sheets to specialty carpenters and furniture installers. The company serves thousands of furniture and case good manufacturers operating in the education, healthcare, retail, hospitality, commercial, recreational vehicle, and residential markets. Charter Industries is based in Kentwood, Michigan. |

Secondary Buyout |

Wynnchurch Capital

|

Incline Equity Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-07-28 |

FlavorSum

Food Kalamazoo, Michigan www.flavorsum.com FlavorSum is a provider of natural flavor solutions for food & beverage companies. FlavorSum was founded in 1941 and is based in Kalamazoo, Michigan. Advisors: Jones Day , Houlihan Lokey , Cascadia Capital |

Secondary Buyout |

Warburg Pincus

|

Riverside

|

||

| Deal Article Deal Link | ||||||

| 2025-06-01 |

Centaris

Information Technology Sterling Heights, Michigan www.centaris.com Centaris is a provider of information technology and telephony services, primarily to small- and medium-sized enterprises. The Company was formed via the simultaneous acquisition and merger of two successful businesses. Centaris is based in Sterling Heights, Michigan. |

Secondary Buyout |

Longshore Capital Partners

|

Peninsula Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-04-21 |

GSTV

Media Detroit, Michigan www.gstv.com GSTV is a media network for reaching on-the-go consumers. GSTV engages, influences and drives consumers to action with exclusive content from ESPN, CNN's Headline News and Buzz Today, Bloomberg TV, and AccuWeather at fuel retailers across the country. Its growing viewership continues to solidify video at the pump as an exemplary platform to reach a captivated, real-time audience. GSTV was founded in 2006 and is based in Detroit, Michigan. Advisors: Honigman , Moelis & Co. , Solomon Partners |

Secondary Buyout |

MidOcean Partners

Monroe Capital

Alvarez & Marsal Capital

|

Rockbridge Growth Equity

Beringea

|

||

| Deal Article Deal Link | ||||||

| 2025-02-03 |

Arotech

Defense Ann Arbor, Michigan www.arotech.com Arotech is an engineering solutions company that offers training & simulation and power systems solutions to military, law enforcement and homeland security markets. The Power Systems Division develops special-purpose batteries, smart chargers and electronic components through operations in South Carolina and Israel. The Training & Simulation Division develops, manufactures and markets advanced multi-media and interactive digital solutions for engineering, use-of-force and operator training simulations. Arotech was founded in 1990 and is based in Ann Arbor, Michigan. |

Secondary Buyout |

Albion River

|

Greenbriar Equity Group

|

||

| Deal Article Deal Link | ||||||

| 2025-01-06 |

Mopec

Medical Products Oak Park, Michigan www.mopec.com Mopec is a manufacture of pathology and mortuary equipment. Its product line includes dissecting instruments, autopsy accessories, fume handling equipment, dissection tables, grossing workstations, and morgue refrigerators. Mopec was founded in 1992 and is based in Oak Park, Michigan. Advisors: Varnum , Piper Sandler & Co. |

Secondary Buyout |

Waud Capital Partners

|

Blackford Capital

Northcreek Mezzanine

|

||

| Deal Article Deal Link | ||||||

| 2024-11-13 |

Continental Services

Business Services Detroit, Michigan www.continentalserves.com Continental Services is a provider of a spectrum of tailored services, including vending services, office coffee replenishment, corporate cafés, grab-and-go markets, and special events. Continental Services was founded in 1990 and is based in Detroit, Michigan. Advisors: Taft Stettinius & Hollister , Latham & Watkins , Lazard |

Secondary Buyout |

Morgan Street Holdings

|

New Heritage Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-11-12 |

Testek Solutions

Aerospace Wixom, Michigan www.testek.com Testek Solutions designs, manufactures, and supports highly reliable aerospace and defense test equipment and testing facilities for OEMs, MROs, and operators. Testek Solutions was founded in 1969 and is based in Wixom, Michigan. |

Secondary Buyout |

Branford Castle Partners

Siguler Guff & Company

|

Odyssey Investment Partners

CW Industrial Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-10-16 |

Pinnacle

Business Services Clair Shores, Michigan www.pinnacle-mep.com Pinnacle is a provider of mechanical contracting services, including HVAC, plumbing and insulation, in the Midwest. The Company is focused on serving primarily commercial customers with projects ranging from annual equipment tune-ups to whole facility retrofits. Pinnacle is based in Clair Shores, Michigan. |

Secondary Buyout |

Blue Point Capital Partners

|

The Firmament Group

|

||

| Deal Article Deal Link | ||||||

| 2024-09-26 |

Pro-Vision Video Systems

Technology Hardware Byron Center, Michigan www.provisionsolutions.com Pro-Vision Video Systems design manufactures, and installs rugged rear vision and video recording systems, body-worn cameras, and video management software for commercial, law enforcement, and transit applications. Pro-Vision Video Systems was founded in 2003 and is based in Byron Center, Michigan. Advisors: Goodwin Procter , P&M Corporate Finance |

Secondary Buyout |

Vance Street Capital

Barings Private Equity

|

JMC Capital Partners

Great River Capital Partners

GarMark Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-08-15 |

Service Express

Information Technology Grand Rapids, Michigan www.serviceexpress.com Service Express is a provider of third-party maintenance services for mission-critical data center infrastructure focused on server and storage equipment. Service Express was founded in 1986 and is based in Grand Rapids, Michigan. Advisors: Kirkland & Ellis , J.P. Morgan Securities , William Blair |

Secondary Buyout |

Warburg Pincus

|

Harvest Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-05-31 |

I-Deal Optics

Consumer Products Troy, Michigan www.i-dealoptics.com I-Deal Optics is a manufacturer and distributor of quality budget eyewear and sun wear. I-Deal Optics delivers a combination of innovation and quality at the best prices possible across a broad portfolio of products consisting of eight brands and over six hundred styles. I-Deal Optics was founded in 1996 and is based in Troy, Michigan. |

Secondary Buyout |

Highland Rim Capital

|

Main Street Capital Holdings

|

||

| Deal Article Deal Link | ||||||

| 2024-02-23 |

SurfacePrep

Distribution Byron Center, Michigan www.surfaceprep.com SurfacePrep is a distributor of loose abrasives, specialty ceramics, and surface enhancement equipment. The company’s technical sales professionals support manufacturing customers through a network of over 30 distribution branches and more than 10 process development labs and production finishing centers. SurfacePrep is based in Byron Center, Michigan. Advisors: Gibson, Dunn & Crutcher , KeyBanc Capital Markets |

Secondary Buyout |

Nautic Partners

|

CenterOak Partners

|

||

| Deal Article Deal Link | ||||||

| 2023-08-22 |

Ascent Global Logistics

Transportation Belleville, Michigan www.ascentlogistics.com Ascent Global Logistics is a transportation and supply chain solutions provider. Ascent Global Logistics is based in Belleville, Michigan. Advisor: Debevoise & Plimpton |

Secondary Buyout |

H.I.G. Private Equity

|

Elliott

|

||

| Deal Article Deal Link | ||||||

| 2023-08-15 |

Hardenbergh Group

Staffing Livonia, Michigan www.hardenberghgroup.com Hardenbergh Group is a provider of temporary staffing and consulting solutions for medical staff services, credentialing, and provider enrollment. Hardenbergh Group was founded in 1991 and is based in Livonia, Michigan. Advisors: Bass, Berry & Sims , Silvermark Partners |

Secondary Buyout |

BV Investment Partners

Stellus Capital Management

|

Lead Capital Partners

|

||

| Deal Article Deal Link | ||||||

| Avg |

$263

0.0x EBITDA 0.0x REVENUE |

|||||

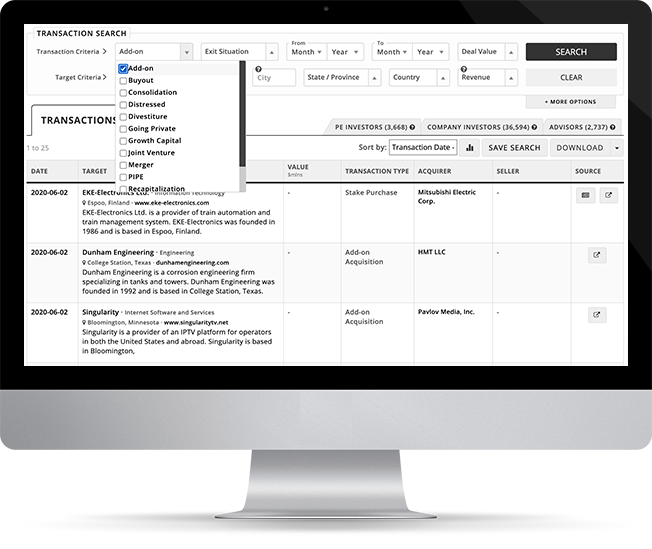

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.