| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-11-17 |

Sealed Air

Packaging Charlotte, North Carolina www.sealedair.com Sealed Air is a provider of food safety and security, facility hygiene and product protection. Sealed Air serves an array of end markets including food and beverage processing, food service, retail, healthcare and industrial, and commercial and consumer applications. Sealed Air was formed in 1960 and is based in Charlotte, North Carolina.

|

Going Private

|

CD&R

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-22 |

Premier

Information Technology Charlotte, North Carolina www.premierinc.com Premier is a healthcare improvement company, uniting an alliance of approximately 3,600 U.S. hospitals and 120,000 other providers to transform healthcare. With integrated data and analytics, collaboratives, supply chain solutions, and advisory and other services, the company enables better care and outcomes at a lower cost. It delivers value through a comprehensive technology-enabled platform that offers supply chain services, clinical, financial, operational and population health software-as-a-service (SaaS) informatics products, advisory services and performance improvement collaborative programs. Premier was founded in 2013 and is based in Charlotte, North Carolina. Advisors: Wachtell, Lipton, Rosen & Katz , BofA Securities , Goldman Sachs |

Going Private |

Patient Square Capital

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-05-06 |

AvidXchange

Internet Software and Services Charlotte, North Carolina www.avidxchange.com AvidXchange is a SaaS-based provider of accounts payable management solutions for mid-sized companies in the real estate, banking, and healthcare industries. The company's product suite integrates with a customer's existing accounting systems to centralize and streamline accounts payable workflow. AvidXchange was formed in 2000 and is based in Charlotte, North Carolina.

|

Going Private

|

TPG

Corpay

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2023-09-18 |

HS GovTech

Internet Software and Services Charlotte, North Carolina www.hsgovtech.com HS GovTech is a provider of web-based and mobile solutions for health and safety regulatory agencies across North America. Its platforms support inspection, information, communication, and data management to help government agencies manage operations. HS GovTech was founded in 1999 and is based in Charlotte, North Carolina. Advisor: McMillan |

Going Private

|

Banneker Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2023-05-10 |

Syneos Health

Life Science Morrisville, North Carolina www.syneoshealth.com Syneos Health is a fully integrated biopharmaceutical solutions organization built to accelerate customer success. Syneos Health translate unique clinical, medical affairs and commercial insights into outcomes to address modern market realities. Syneos Health was founded in 2010 and is based in Morrisville, North Carolina.

|

Going Private

|

Elliott

Patient Square Capital

Veritas Capital

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2022-08-08 |

Avalara

Internet Software and Services Durham, North Carolina www.avalara.com Avalara provides a suite of cloud-based solutions designed to improve accuracy and efficiency by automating the processes of determining taxability, identifying applicable tax rates, determining and collecting taxes, preparing and filing returns, remitting taxes, maintaining tax records, and managing compliance documents. Avalara was formed in 2004 and is based in Durham, North Carolina.

|

Going Private

|

Vista Equity Partners

Mubadala Capital

BlackRock

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2022-03-07 |

Cornerstone Building Brands

Building Materials Cary, North Carolina www.cornerstonebuildingbrands.com Cornerstone Building Brands is an integrated manufacturer of metal products for the nonresidential building industry. Cornerstone Building Brands was formed in 1984 and is based in Cary, North Carolina.

|

Going Private

|

CD&R

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2021-12-13 |

SPX Flow

Manufacturing Charlotte, North Carolina www.spxflow.com SPX Flow solves processing challenges, helping customers lower costs, increase uptime, save energy, reduce waste, and improve quality. The company's product offering is concentrated in process technologies that perform mixing, blending, fluid handling, separation, thermal heat transfer, and other activities that are integral to processes performed across a wide variety of nutrition, health, and precision solutions markets. SPX Flow was founded in 2015 and is based in Charlotte, North Carolina.

|

Going Private

|

Lone Star Funds

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2021-03-15 |

Extended Stay America

Leisure Charlotte, North Carolina www.extendedstayamerica.com Extended Stay America is an operator of moderate-price extended-stay hotels in North America, with 600+ hotels and approximately 76,000 rooms located in 44 states and Canada. The Company currently operates under five brands in the extended-stay segment: Extended Stay Deluxe, Extended Stay America, Homestead Studio Suites, StudioPlus and Crossland. Extended Stay America was founded in 1995 and is headquartered in Charlotte, North Carolina.

|

Going Private

|

The Blackstone Group

Starwood Capital Group

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2018-11-06 |

Bojangles

Restaurants Charlotte, North Carolina www.bojangles.com Bojangles is a restaurant operator and franchisor dedicated to serving customers high-quality, craveable food made from its Southern recipes, including breakfast served All Day, Every Day. Bojangles was founded in 1977 and is based in Charlotte, North Carolina. Advisors: Shearman & Sterling , BofA Securities , Houlihan Lokey |

Going Private |

Durational Capital Management

TJC

Industrial Investors Group

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2018-01-31 |

Ply Gem Industries, Inc.

Building Materials Cary, North Carolina www.plygem.com Ply Gem Industries, Inc. is a manufacturer of building products in North America. Number one in vinyl siding and in vinyl and aluminum windows, Ply Gem produces a comprehensive product line of windows and patio doors, vinyl and aluminum siding and accessories, designer accents, cellular PVC trim and mouldings, vinyl fencing and railing, stone veneer, roofing and gutterware products, used in both new construction and home repair and remodeling across the United States and Canada. Advisors: Paul, Weiss, Rifkind, Wharton & Garrison , Credit Suisse Investment Banking |

Going Private

|

CD&R

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2017-06-20 |

Parexel

Life Science Durham, North Carolina www.parexel.com Parexel is a global provider of clinical research and consulting services to the pharma and biotech industry. Parexel’s services enable the development of innovative new medicines that improve the health of patients across the world. Parexel was founded in 1983 and is based in Durham, North Carolina. Advisors: Goodwin Procter , Goldman Sachs |

Going Private

|

Pamplona Capital Management - Private Equity

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2017-02-20 |

Segra

Communications Charlotte, North Carolina www.segra.com Segra is a provider of mission-critical connectivity solutions over a fiber-based network. Representing a successful combination of Lumos Networks and Spirit Communications. Segra provides Ethernet, MPLS, dark fiber, advanced data center services, IP and managed services, voice and cloud solutions, all backed by its industry-leading service and reliability. Segra is headquartered in Charlotte, North Carolina.

|

Going Private

|

EQT

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2016-10-24 |

Elevate Textiles

Apparel/Textiles Greensboro, North Carolina www.elevatetextiles.com Elevate Textiles is a global, diversified provider of textile solutions across performance & specialty apparel fabrics, advanced uniform fabrics, technical commercial fabrics and engineered automotive components. Elevate Textiles businesses include: Burlington, Cone Denim, Safety Components and Carlisle Finishing. Elevate Textiles is based in Greensboro, North Carolina. |

Going Private |

Platinum Equity

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2016-05-31 |

Jaggaer

Software Durham, North Carolina www.jaggaer.com Jaggaer is a provider of procurement software for large and medium-sized enterprises. Jaggaer provides cloud-based Source-to-Pay eProcurement solutions for spend management, which enables a fluid supply chain for its customers, driven by powerful spend analytics, vendor sourcing, contract lifecycle management, savings tracking, and efficient accounts payable systems on a single platform. Jaggaer was founded in 1995 and is based in Durham, North Carolina.

|

Going Private

|

Accel-KKR

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2016-05-09 |

Krispy Kreme

Restaurants Charlotte, North Carolina www.krispykreme.com Krispy Kreme is a branded specialty retailer and wholesaler of sweet treats and complementary products, including its signature Original Glazed doughnut. Krispy Kreme was formed in 1937 and is based in Charlotte, North Carolina.

|

Going Private

|

JAB Holding Company

|

- | ||||||

| Deal Link | ||||||||||

| Avg |

$3,125

23.1x EBITDA 4.6x REVENUE |

|||||||||

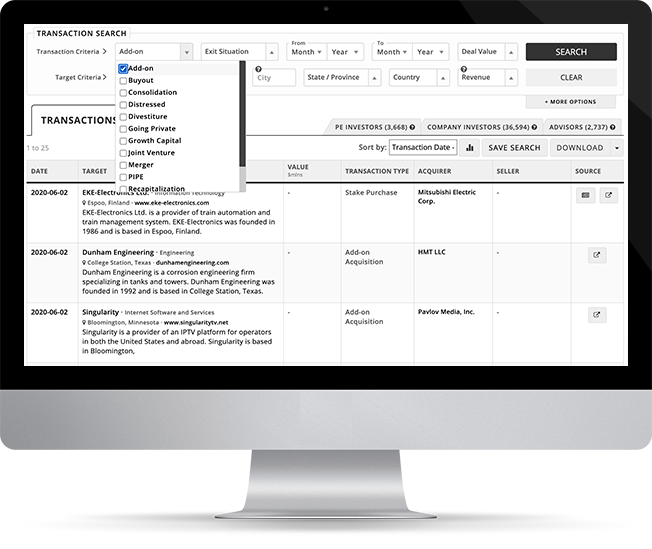

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.