| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-12-29 |

Moro

Building Materials Natick, Massachusetts www.morocorp.com Moro is a construction products and services company, providing HVAC, electrical, structural steel, sheet metal ductwork and services to a variety of commercial and residential customers located in Pennsylvania, New Jersey, New York, Connecticut, Rhode Island and Massachusetts. Moro was founded in 2000 and is based in Natick, Massachusetts.

|

Going Private

|

Blackford Capital

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-12-21 |

Clearwater Analytics

Internet Software and Services Boise, Idaho www.clearwateranalytics.com Clearwater Analytics provides web-based, investment portfolio reporting and analytics for institutional investors, investment managers, custody banks, and electronic trading portals. Its daily-aggregated and reconciled solutions deliver the highest level of portfolio transparency available on the market today for clients such as Cisco Systems, Oracle Corporation, Starbucks Corporation, and Yahoo!. Clearwater Analytics was founded in 2004 and is based in Boise, Idaho.

|

Going Private

|

Permira

Warburg Pincus

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-12-15 |

Quipt Home Medical

Healthcare Services Wilder, Kentucky www.quipthomemedical.com Quipt Home Medical provides in-home monitoring and disease management services including end-to-end respiratory solutions for patients. Quipt Home Medical is based in Wilder, Kentucky.

|

Going Private

|

Kingswood Capital Management

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-11-17 |

Sealed Air

Packaging Charlotte, North Carolina www.sealedair.com Sealed Air is a provider of food safety and security, facility hygiene and product protection. Sealed Air serves an array of end markets including food and beverage processing, food service, retail, healthcare and industrial, and commercial and consumer applications. Sealed Air was formed in 1960 and is based in Charlotte, North Carolina.

|

Going Private

|

CD&R

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-11-10 |

TreeHouse Foods

Food Oak Brook, Illinois www.treehousefoods.com TreeHouse Foods manufactures and distributes private-label food and beverage products across North America. The Company produces snacks, beverages, and meal ingredients, including crackers, coffee, pretzels, cookies, powdered drinks, and condiments, serving grocery retailers, foodservice operators, and e-commerce brands. TreeHouse Foods is headquartered in Oak Brook, Illinois.

|

Going Private

|

Investindustrial

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-11-03 |

Denny's

Restaurants Spartanburg, South Carolina www.dennys.com Denny’s operates a network of casual dining restaurants serving breakfast, lunch, and dinner items across the United States and internationally. Denny's menu includes traditional diner fare such as pancakes, burgers, sandwiches, and salads, with many locations open 24 hours a day. Denny’s was founded in 1953 and is headquartered in Spartanburg, South Carolina.

|

Going Private

|

TriArtisan Capital Advisors

Yadav Enterprises

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-10-29 |

Jamf

Software Minneapolis, Minnesota www.jamf.com Jamf provides enterprise device management and security software designed for Apple ecosystems. The Company’s cloud-based platform enables organizations to deploy, manage, and protect Apple devices across education, business, and government environments. Jamf was founded in 2002 and is headquartered in Minneapolis, Minnesota.

|

Going Private

|

Francisco Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-10-21 |

Hologic

Medical Products Marlborough, Massachusetts www.hologic.com Hologic is a developer, manufacturer and supplier of premium diagnostic products, medical imaging systems, and surgical products, with an emphasis on serving the healthcare needs of women throughout the world. Hologic was formed in 1985 and is based in Marlborough, Massachusetts.

|

Going Private

|

The Blackstone Group

TPG

ADIA

GIC

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-10-15 |

Hillenbrand

Machinery Batesville, Indiana www.hillenbrand.com Hillenbrand is a diversified industrial company with multiple market-leading brands that serve a wide variety of industries across the globe. The company's portfolio is composed of two business segments: the Process Equipment Group and Batesville. The Process Equipment Group businesses design, develop, manufacture, and service highly engineered industrial equipment around the world. Hillenbrand was founded in 1906 and is based in Batesville, Indiana.

|

Going Private

|

Lone Star Funds

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-10-06 |

Heidrick & Struggles International

Staffing Chicago, Illinois www.heidrick.com Heidrick & Struggles International serves the executive talent and leadership needs of the world's top organizations as the provider of leadership consulting, culture shaping and senior-level executive search services. Heidrick & Struggles International was founded in 1953 and is based in Chicago, Illinois.

|

Going Private

|

Advent International

Corvex Private Equity

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-29 |

Electronic Arts

Digital Media Redwood City, California www.ea.com Electronic Arts is a producer of video games. Electronic Arts develops and delivers games, content and online services for Internet-connected consoles, mobile devices and personal computers. Electronic Arts was founded in 1982 and is based in Redwood City, California.

|

Going Private

|

Affinity Partners

Silver Lake

PIF

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-24 |

IAS

Digital Media New York, New York www.integralads.com IAS is a technology company specializing in measuring media quality to verify and optimize the placement of digital advertisements. IAS's capabilities include fraud detection, viewability assessment, brand safety assurance, and optimization services. IAS was founded in 2009 and is based in New York, New York.

|

Going Private

|

Novacap

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-22 |

Office Depot

Retail Boca Raton, Florida www.officedepot.com Office Depot is a retailer and provider of office products and services. The company operating through its direct and indirect subsidiaries, maintains a fully integrated B2B distribution platform of approximately 1,300 stores, an online presence, and thousands of dedicated sales and technical service professionals, all supported by its world-class supply chain facilities and delivery operations. Office Depot was founded in 1986 and is based in Boca Raton, Florida. Advisors: Simpson Thacher & Bartlett , J.P. Morgan Securities |

Going Private |

Atlas Holdings

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-22 |

PROS

Software Houston, Texas www.pros.com PROS is a provider of pricing and revenue optimization software products, specializing in price analytics, price execution, and price optimization. PROS was founded in 1985 and is based in Houston, Texas.

|

Going Private

|

Thoma Bravo

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-09-22 |

Premier

Information Technology Charlotte, North Carolina www.premierinc.com Premier is a healthcare improvement company, uniting an alliance of approximately 3,600 U.S. hospitals and 120,000 other providers to transform healthcare. With integrated data and analytics, collaboratives, supply chain solutions, and advisory and other services, the company enables better care and outcomes at a lower cost. It delivers value through a comprehensive technology-enabled platform that offers supply chain services, clinical, financial, operational and population health software-as-a-service (SaaS) informatics products, advisory services and performance improvement collaborative programs. Premier was founded in 2013 and is based in Charlotte, North Carolina. Advisors: Wachtell, Lipton, Rosen & Katz , BofA Securities , Goldman Sachs |

Going Private |

Patient Square Capital

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2025-08-25 |

Verint

Information Technology Melville, New York www.verint.com Verint is a provider of Actionable Intelligence solutions to clients. The company's portfolio of Enterprise Intelligence Solutions and Security Intelligence Solutions helps organizations Make Big Data Actionable through the ability to capture, analyze and act on large volumes of rich, complex, and often underused information sources such as voice, video, and unstructured text. Verint was founded in 1994 and is based in Melville, New York.

|

Going Private

|

Thoma Bravo

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| Avg |

$3,299

27.1x EBITDA 4.4x REVENUE |

|||||||||

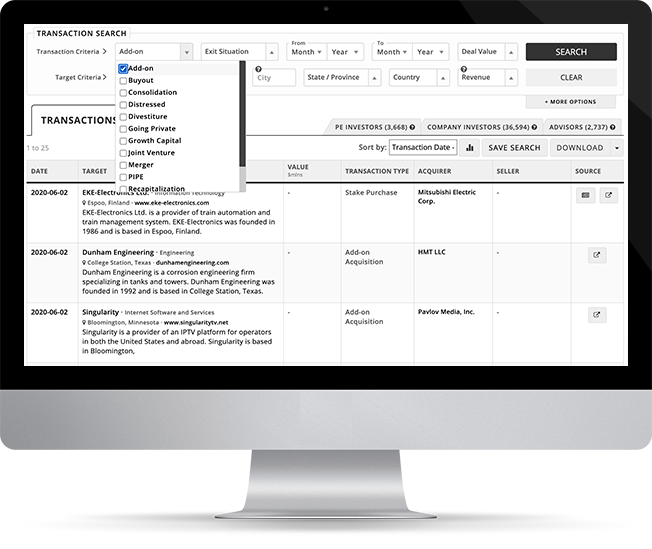

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.