| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|

|---|---|---|---|---|

| Total | Current | |||

|

The Blackstone Group

New York, New York, United States |

131,000 | 348 | 131 |

|

|

Apax

London, United Kingdom |

77,000 | 273 | 75 |

|

|

Clairvest Group

Toronto, Ontario, Canada |

3,420 | 59 | 22 |

|

|

General Atlantic

New York, New York, United States |

73,000 | 394 | 195 |

|

Washington, District of Columbia, United States |

435,000 | 771 | 144 |

|

|

Levine Leichtman Capital Partners

Beverly Hills, California, United States |

12,900 | 100 | 29 |

|

|

Trive Capital

Dallas, Texas, United States |

7,000 | 55 | 31 |

|

|

Ames Watson

Columbia, Maryland, United States |

- | 4 | 4 |

|

|

TPG

Fort Worth, Texas, United States |

137,000 | 484 | 127 |

|

|

Terra Firma Capital Partners

London, United Kingdom |

27,709 | 39 | 4 |

|

|

Apollo Global Management

New York, New York, United States |

45,000 | 145 | 72 |

|

|

HgCapital

London, United Kingdom |

70,000 | 157 | 56 |

|

|

Waterland Private Equity

Bussum, Netherlands |

4,508 | 116 | 57 |

|

|

Cinven

London, United Kingdom |

43,949 | 188 | 38 |

|

|

Trilantic North America

New York, New York, United States |

9,700 | 59 | 26 |

|

|

CVC Capital Partners

Luxembourg, Luxembourg |

199,461 | 330 | 132 |

|

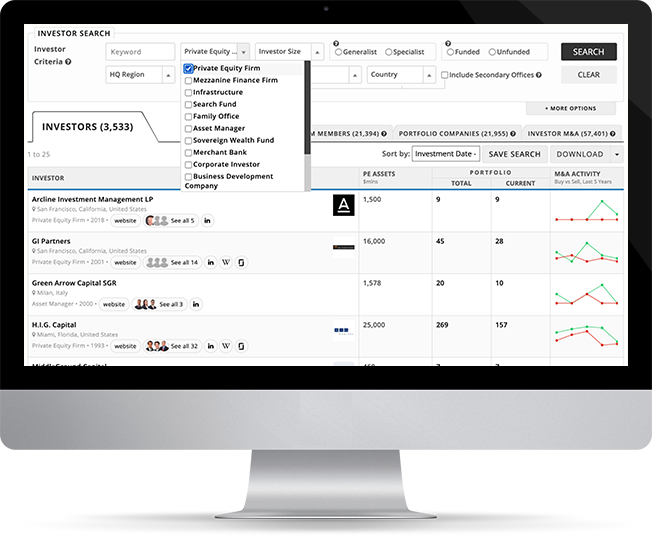

We built Mergr to save people the arduous and time-consuming process of tracking when companies are bought, sold, and who currently owns them.

Every day, new opportunities emerge around M&A and we help professionals of all types comb through transactions, investors, and corporate acquirers via an easy-to-use web database that is accessible to anyone.

Try us for 1 week free today!

No obligation. Cancel anytime.