| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||

|---|---|---|---|---|---|---|

| 2025-05-21 |

Beneficial Reuse Management

Distribution Chicago, Illinois www.beneficialreuse.com Beneficial Reuse Management is a manufacturer and distributor of specialty agricultural and construction products using material sourced from the reusable by-product streams of utilities, municipalities, and industrial companies. Gypsoil provides valuable nutrients and improves soil structure for farmers. Beneficial Reuse Management was formed in 1999 and is based in Chicago, Illinois. Advisor: Raymond James - Investment Banking |

Recapitalization |

Clairvest Group

|

Skyline Global Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-02-27 |

H3

Manufacturing Champaign, Illinois www.h3mfggroup.com H3 is a manufacturer specializing in complex, custom weldments and sheet metal fabrication serving the medical, power, and transportation industries. H3 is comprised of Hi-Grade Welding and Manufacturing and HL Precision Manufacturing. H3 was founded in 2019 and is based in Champaign, Illinois. |

Recapitalization |

Rock Gate Partners

Ironwood Capital

|

Aldine Capital Partners

Capital For Business

|

||

| Deal Article Deal Link | ||||||

| 2024-12-19 |

KKSP Precision Machining

Manufacturing Glendale Heights, Illinois www.kksp.com KKSP Precision Machining is a contract manufacturer of high-volume, medium-tolerance, precision-machined metal components for a variety of applications. K&K specializes in brass components and is the largest Davenport screw machine operator in the United States. KKSP Precision Machining was founded in 1968 and is based in Glendale Heights, Illinois. |

Recapitalization |

Red Arts Capital

|

Pine Grove Holdings

|

||

| Deal Article Deal Link | ||||||

| 2024-11-21 |

Point C

Business Services Chicago, Illinois www.pointchealth.com Point C is a third party administration platform for medical and dental benefits for self-insured employers. Administrative services the company currently provides include claims processing, network management, and utilization review. Point C’s mission is to support TPA partners through business process innovations and product solutions that drive value for employers and enhance the member experience. Point C is based in Chicago, Illinois. |

Recapitalization |

Shore Capital Partners

|

Shore Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2023-11-03 |

Parts Town

Distribution Addison, Illinois www.partstown.com Parts Town is a distributor of genuine OEM restaurant equipment parts for the foodservice industry. Focused on delivering a unique customer service experience and website, Parts Town customizes solutions for both chain restaurants and food equipment service companies. Parts Town partners closely with the leading manufacturers of commercial cooking, refrigeration, ice, and beverage equipment to improve their parts supply chain, delight their customers, and grow genuine parts sales. Parts Town was founded in 1987 and is based in Addison, Illinois. |

Recapitalization |

Leonard Green & Partners

|

Berkshire Partners

|

||

| Deal Article Deal Link | ||||||

| 2022-08-25 |

Curion

Information Services Deerfield, Illinois www.curioninsights.com Curion is a data-driven consumer insights firm specializing in full-service qualitative, quantitative, and sensory research for brands. The company provides comprehensive insights on products and consumers for many prominent brands to help them develop and optimize products. Curion is based in Deerfield, Illinois. Advisors: Brownstein , JEGI Clarity |

Recapitalization |

Summit Park

Stellus Capital Management

|

Monroe Capital

|

||

| Deal Article Deal Link | ||||||

| 2022-01-04 |

Addison Group

Staffing Chicago, Illinois www.addisongroup.com Addison Group delivers the expertise and talent that companies need to achieve and sustain business growth, offering a full suite of consulting services and talent solution capabilities across multiple sectors, including information technology, finance and accounting, healthcare, human resources, administrative, and digital marketing. Addison Group was formed in 1999 and is based in Chicago, Illinois. Advisors: Latham & Watkins , Houlihan Lokey |

Recapitalization |

Trilantic North America

NB Private Equity Partners

|

Odyssey Investment Partners

|

||

| Deal Article Deal Link | ||||||

| 2021-11-18 |

Berlin Packaging

Packaging Chicago, Illinois www.berlinpackaging.com Berlin Packaging is a supplier of custom and stock rigid packaging and related solutions to large and small customers nationwide in end markets such as food and beverage, household/personal care, healthcare, and chemicals. Berlin Packaging was founded in 1898 and is based in Chicago, Illinois. |

Recapitalization |

Oak Hill Capital

CPP Investments

|

Oak Hill Capital

|

||

| Deal Article Deal Link | ||||||

| 2021-08-05 |

Eclipse Business Capital

Financial Services Chicago, Illinois www.eclipsebuscap.com Eclipse Business Capital is an asset-based lending platform that provides financing to middle-market borrowers. Encina provides revolving lines of credit and term loans ranging in size from $10–$100 million which are secured by accounts receivable, inventory, machinery & equipment, and real estate. Eclipse Business Capital was founded in 2016 and is based in Chicago, Illinois. Advisors: Skadden, Arps, Slate, Meagher & Flom , Wells Fargo Securities |

Recapitalization |

Barings

|

Cequel III

|

||

| Deal Article Deal Link | ||||||

| 2021-05-17 |

TCC Wireless

Communications Bloomingdale, Illinois www.tccmobile.com TCC Wireless operates wireless retail stores in several cities throughout the Midwest and Northeast United States. TCC Wireless was founded in 2013 and is based in Bloomingdale, Illinois. Advisor: Cascade Partners |

Recapitalization | - |

Onex Falcon

|

||

| 2021-03-17 |

AIT Worldwide Logistics

Transportation Itasca, Illinois www.aitworldwide.com AIT Worldwide Logistics is a global freight forwarder that helps its customers grow by expanding access to markets all over the world where they can sell and/or procure raw materials, components, and finished goods. AIT Worldwide Logistics was founded in 1979 and is based in Itasca, Illinois. Advisors: White & Case , Harris Williams |

Recapitalization

|

TJC

|

Quad-C Management

|

||

| Deal Article Deal Link | ||||||

| 2021-01-07 |

SEKO

Transportation Schaumburg, Illinois www.sekologistics.com SEKO is a global non-asset-based 3PL provider offering a complete set of technology-enabled supply chain logistics solutions, including freight forwarding, transportation management, contract logistics and warehousing services. SEKO was founded in 1976 and is based in Schaumburg, Illinois. Advisors: Hughes Hubbard & Reed , Raymond James - Investment Banking , Jefferies |

Recapitalization |

Ridgemont Equity Partners

Bregal Sagemount

|

Greenbriar Equity Group

|

||

| Deal Article Deal Link | ||||||

| 2020-10-06 |

Energy Distribution Partners

Oil/Gas Exploration Chicago, Illinois www.edplp.net Energy Distribution Partners actively acquires and operates residential and commercial propane and natural gas distributors as well as wholesale and midstream energy distribution operations. Energy Distribution Partners was founded in 2011 and is based in Chicago, Illinois. Advisor: Stifel |

Recapitalization |

Pritzker Private Capital

|

Concentric Equity Partners

Duchossois Capital Management

Beverly Capital

|

||

| Deal Article Deal Link | ||||||

| 2020-02-03 |

HaystackID

Software Chicago, Illinois www.haystackid.com HaystackID is an international end-to-end eDiscovery and forensics services and solutions provider. The Company offers consultation and solutions to corporations and law firms that vastly improve legal hold, data collection and eDiscovery workflow. Haystack's goal is to work collaboratively to lower overall spend and minimize risk while improving efficiency. HaystackID was founded in 2011 and is based in Chicago, Illinois. |

Recapitalization |

Quad-C Management

|

Knox Capital

Maranon Capital

ORIX Private Equity Solutions

|

||

| Deal Article Deal Link | ||||||

| 2019-09-26 |

Cole-Parmer Instrument

Test/Measurement Equipment Vernon Hills, Illinois www.coleparmer.com Cole-Parmer Instrument is a global supplier of fluid handling, test & measurement, environmental, and biosciences instrumentation with expertise in peristaltic technologies, temperature control, electrochemistry, water and air testing, and chromatography. Its portfolio includes brands such as Masterflex, Environmental Express, and Traceable, serving research and production needs across life sciences, healthcare, environmental, and industrial markets. Cole-Parmer Instrument was founded in 1955 and is based in Vernon Hills, Illinois. Advisor: Jefferies |

Recapitalization |

GTCR

Golden Gate Capital

|

Golden Gate Capital

|

||

| Deal Article Deal Link | ||||||

| 2019-05-09 |

Chartis

Business Services Chicago, Illinois www.chartis.com Chartis is a healthcare advisory firm that develops and activates transformative strategies, operating models, and organizational enterprises. The company helps providers, payers, technology innovators, retail companies, and investors create and embrace solutions that radically reshape healthcare for the better. Its family of brands includes Chartis, Jarrard, Greeley, and HealthScape Advisors. Chartis was founded in 2002 and is based in Chicago, Illinois. Advisors: Winston & Strawn , Lincoln International |

Recapitalization |

Audax Private Equity

|

RLH Equity Partners

|

||

| Deal Article Deal Link | ||||||

| Avg |

$1,205

0.0x EBITDA 0.0x REVENUE |

|||||

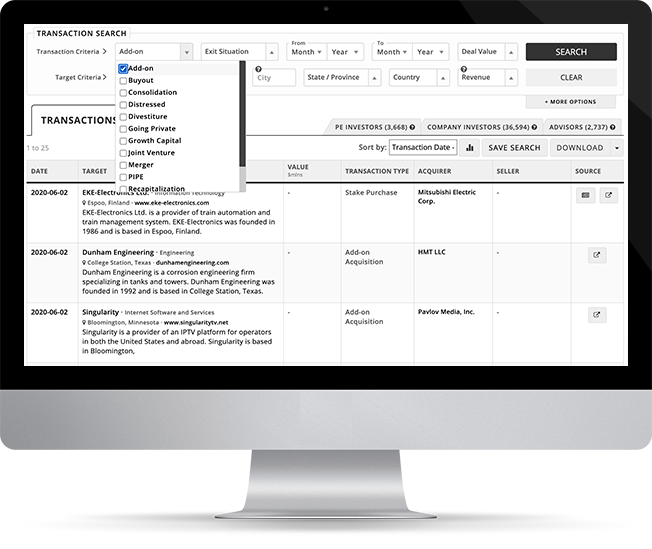

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.