| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||

|---|---|---|---|---|---|---|

| 2025-09-19 |

OneDigital

Insurance Atlanta, Georgia www.onedigital.com OneDigital is a pure-play employee-benefits broker in the United States. OneDigital delivers benefits solutions for employers of all sizes through a sophisticated combination of strategic advisory services, proprietary technology, advanced analytics, compliance support, technical innovations and HR capital management tools. OneDigital was founded in 2000 and is based in Atlanta, Georgia. Advisors: Kirkland & Ellis , Barclays Investment Bank , Evercore Group , Ardea Partners |

Recapitalization |

Stone Point Capital

CPP Investments

Onex Partners

|

New Mountain Capital

Onex Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-09-10 |

GCG Wealth Management

Financial Services Charlotte, North Carolina www.gcgwm.com GCG Wealth Management is a regional financial services firm with field offices across the Southeast US. GCG offers a broad spectrum of services aimed at building and managing wealth including, but not limited to, financial planning, retirement and estate preservation, risk management, and family wealth counseling. GCG Wealth Management was founded in 1994 and is based in Charlotte, North Carolina. Advisor: Houlihan Lokey |

Recapitalization |

BharCap Partners

|

LNC Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-06-18 |

USG Water Solutions

Utilities Atlanta, Georgia www.usgwater.com USG Water Solutions is a provider of water asset management services for small and medium public water utilities in North America. USG’s offerings include maintenance services for water storage tanks, pipe networks, and concrete structures in water and wastewater plants. USG Water Solutions is based in Atlanta, Georgia. |

Recapitalization |

Turnspire Capital Partners

|

Turnspire Capital Partners

Backcast Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-06-12 |

Unosquare

Software Portland, Oregon www.unosquare.com Unosquare is an outsourced software engineering and development company. Unosquare provides outsourced software development services along with complementary practices such as quality assurance, mobile development, UX/UI design, business intelligence, project management, and platform customization & integration. Unosquare was founded in 2009 and is based in Portland, Oregon. Advisors: Benesch, Friedlander, Coplan & Aronoff , Clearsight Advisors |

Recapitalization |

Ridgemont Equity Partners

|

Trivest Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-05-21 |

Beneficial Reuse Management

Distribution Chicago, Illinois www.beneficialreuse.com Beneficial Reuse Management is a manufacturer and distributor of specialty agricultural and construction products using material sourced from the reusable by-product streams of utilities, municipalities, and industrial companies. Gypsoil provides valuable nutrients and improves soil structure for farmers. Beneficial Reuse Management was formed in 1999 and is based in Chicago, Illinois. Advisor: Raymond James - Investment Banking |

Recapitalization |

Clairvest Group

|

Skyline Global Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-04-15 |

AOM Infusion

Healthcare Services Fort Worth, Texas www.aominfusionrx.com AOM Infusion is a specialty infusion provider focused on intravenous immunoglobulin (“IVIG”) infusion therapy. AOM Infusion was founded in 1994 and is based in Fort Worth, Texas. Advisors: Moelis & Co. , Jefferies |

Recapitalization |

Revelstoke Capital Partners

|

Ridgemont Equity Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-04-07 |

Superscapes

Construction Carrollton, Texas www.superscapes.net Superscapes is a provider of commercial landscaping design, installation, and maintenance services. Superscapes was founded in 2000 and is based in Carrollton, Texas. |

Recapitalization |

TZP Group

GCP Capital Partners

|

Crux Capital

|

||

| Deal Article Deal Link | ||||||

| 2025-04-07 |

Advantmed

Information Services Irvine, California www.advantmed.com Advantmed is a health information management company involved in improving the health of its healthcare system. Advantmed was formed in 2005 and is based in Irvine, California. Advisor: Triple Tree |

Recapitalization |

Webster Equity Partners

|

Bison Capital Asset Management

|

||

| Deal Article Deal Link | ||||||

| 2025-03-14 |

StartKleen

Business Services Gunter, Texas www.startkleen.com StartKleen provides turn-key contract sanitation services to food processing plants with an emphasis on food safety with social, environmental, and economic responsibility. StartKleen provides services to 42 customer plants located throughout the state of Texas and New Mexico. |

Recapitalization |

KCM Capital Partners

|

Fortrex

|

||

| Deal Article Deal Link | ||||||

| 2025-02-27 |

H3

Manufacturing Champaign, Illinois www.h3mfggroup.com H3 is a manufacturer specializing in complex, custom weldments and sheet metal fabrication serving the medical, power, and transportation industries. H3 is comprised of Hi-Grade Welding and Manufacturing and HL Precision Manufacturing. H3 was founded in 2019 and is based in Champaign, Illinois. |

Recapitalization |

Rock Gate Partners

Ironwood Capital

|

Aldine Capital Partners

Capital For Business

|

||

| Deal Article Deal Link | ||||||

| 2025-02-03 |

Kestra Financial

Financial Services Austin, Texas www.kestrafinancial.com Kestra Financial is a provider of independent advisor platforms that empowers sophisticated independent financial professionals, including traditional and hybrid RIAs, to prosper, grow and provide superior client service. Kestra Financial was founded in 1997 and is based in Austin, Texas. |

Recapitalization |

Stone Point Capital

Oak Hill Capital

|

Warburg Pincus

Oak Hill Capital

|

||

| Deal Article Deal Link | ||||||

| 2025-01-06 |

Pearl Meyer

Business Services Wellesley, Massachusetts www.pearlmeyer.com Pearl Meyer is an independent executive compensation consulting firm. PM&P has served as a trusted advisor to Boards and their senior management in the areas of governance, strategy, and compensation program design. Clients from the Fortune 500 to not-for-profits and emerging high-growth companies rely on PM&P to help align rewards with long-term business goals to create value for all stakeholders: shareholders, executives, and employees. Pearl Meyer was founded in 1989 and is based in Wellesley, Massachusetts. Advisors: Locke Lord , Citizens Capital Markets |

Recapitalization |

Coalesce Capital

Audax Private Debt

|

Main Street Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-12-19 |

KKSP Precision Machining

Manufacturing Glendale Heights, Illinois www.kksp.com KKSP Precision Machining is a contract manufacturer of high-volume, medium-tolerance, precision-machined metal components for a variety of applications. K&K specializes in brass components and is the largest Davenport screw machine operator in the United States. KKSP Precision Machining was founded in 1968 and is based in Glendale Heights, Illinois. |

Recapitalization |

Red Arts Capital

|

Pine Grove Holdings

|

||

| Deal Article Deal Link | ||||||

| 2024-12-11 |

Bland Landscaping

Business Services Apex, North Carolina www.blandlandscaping.com Bland Landscaping is a provider of landscape design, installation, enhancement, and maintenance services for commercial properties and high-end residential estates. Bland Landscaping was founded in 1976 and is based in Apex, North Carolina. Advisor: Citizens Capital Markets |

Recapitalization |

Comvest Partners

|

Prospect Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-11-21 |

Point C

Business Services Chicago, Illinois www.pointchealth.com Point C is a third party administration platform for medical and dental benefits for self-insured employers. Administrative services the company currently provides include claims processing, network management, and utilization review. Point C’s mission is to support TPA partners through business process innovations and product solutions that drive value for employers and enhance the member experience. Point C is based in Chicago, Illinois. |

Recapitalization |

Shore Capital Partners

|

Shore Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-05-30 |

NUSO

Software Clayton, Missouri www.nuso.cloud NUSO delivers complex cloud communication solutions in real-time through authorized channel partners serving the small to medium business (SMB) and enterprise markets. NUSO was founded in 2018 and is based in Clayton, Missouri. Advisors: Husch Blackwell , Q Advisors |

Recapitalization |

McCarthy Capital

|

Advantage Capital Partners

|

||

| Deal Article Deal Link | ||||||

| Avg |

$401

0.0x EBITDA 0.0x REVENUE |

|||||

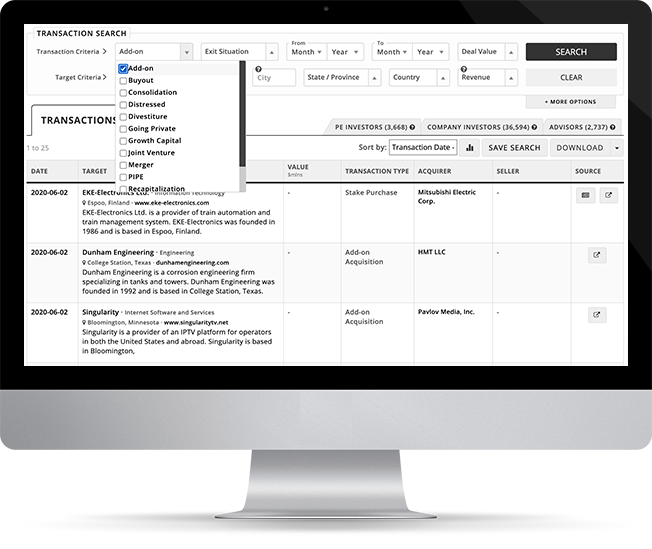

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.