| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 |

ZimVie

Healthcare Services Westminster, Colorado www.zimvie.com ZimVie is a medical technology company, develops, manufactures, and markets a portfolio of products and solutions designed to treat various spine pathologies, and support dental tooth replacement and restoration procedures worldwide. ZimVie is based in Westminster, Colorado.

|

Going Private

|

ArchiMed

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2024-04-08 |

AIR Communities

Real Estate Denver, Colorado www.aircommunities.com AIR Communities is a real estate company with a portfolio of 76 communities totaling 27,010 apartment homes located in 10 states and the District of Columbia. AIR offers a predictable business model with focus on what we call the AIR Edge, the cumulative result of our focus on resident selection, satisfaction, and retention, as well as relentless innovation in delivering best-in-class property management. AIR Communities is based in Denver, Colorado.

|

Going Private

|

The Blackstone Group

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2024-01-05 |

StarTek

Business Services Denver, Colorado www.startek.com StarTek is a provider of delivering customer experience (CX) excellence for brands. Spread across 12 countries, its 38,000 associates create memorable, personalized experiences in both voice and non-voice channels. The company's clients span from Fortune 500s to fast-growing startups in a diverse range of industries, including cable, media, and telecom; travel and hospitality; retail and e-commerce and banking and financial services. StarTek was founded in 1987 and is based in Denver, Colorado. Advisors: Gibson, Dunn & Crutcher , Houlihan Lokey |

Going Private |

Capital Square Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2022-12-16 |

Vantor

Information Services Westminster, Colorado www.vantor.com Vantor is a global communications and information company providing operational solutions to commercial and government organizations worldwide. Vantor business is focused on markets and customers with strong repeat business potential, primarily in the Communications sector and the Surveillance and Intelligence sector. In addition, the Company conducts a significant amount of advanced technology development. Vantor was founded in 1969 and is based in Westminster, Colorado.

|

Going Private

|

Advent International

BCI

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2022-08-03 |

Ping Identity

Information Technology Denver, Colorado www.pingidentity.com Ping Identity engages in Identity Defined Security for the borderless enterprise, allowing employees, customers, and partners access to the applications they need. Protecting over one billion identities worldwide, the company ensures the right people access the right things, securely and seamlessly. More than half of the Fortune 100, including Boeing, Cisco, Disney, GE, Kraft Foods, TIAA-CREF, and Walgreens, trust Ping Identity to solve modern enterprise security challenges created by their use of cloud, mobile, APIs, and IoT. Ping Identity was founded in 2016 and is based in Denver, Colorado.

|

Going Private

|

Thoma Bravo

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2019-05-08 |

Zayo

Communications Boulder, Colorado www.zayo.com Zayo is a provider of bandwidth infrastructure and network neutral colocation and interconnection services. Zayo's services allow its customers, which include telecom carriers, wireless service providers, media and content companies, and other bandwidth-intensive businesses, to transport data, voice, video, and internet traffic, as well as to interconnect their networks. Zayo was founded in 2007 and is based in Boulder, Colorado.

|

Going Private

|

DigitalBridge Group

EQT

Ardian

|

- | ||||||

| Deal Link | ||||||||||

| 2019-03-18 |

Third Coast Midstream

Oil/Gas Exploration Denver, Colorado www.third-coast.com Third Coast Midstream is a growth-oriented natural gas pipeline company that gathers, treats, processes, and transports natural gas. American Midstream Partners owns and operates nine gathering systems, three processing facilities, two interstate pipelines, and six intrastate pipelines. Third Coast Midstream was formed in 2009 and is headquartered in Denver, Colorado. Advisors: Gibson, Dunn & Crutcher , Thompson & Knight LLP , Evercore Group |

Going Private |

ArcLight Capital Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2018-10-22 |

First Bauxite

Metals/Mining Denver, Colorado www.firstbauxite.com First Bauxite is a natural resources company engaged in the exploration and development of bauxite deposits, through resource discovery and mining within a niche industrial market. The company is managed by experienced geoscientists and business development professionals with world-wide experience in the exploration and mining business across a number of mineral commodities. First Bauxite is based in Denver, Colorado. |

Going Private |

Resource Capital Funds

|

- | ||||||

| 2017-05-09 |

Intrado

Internet Software and Services Longmont, Colorado www.intrado.com Intrado is a cloud-based, global technology partner to clients around the world. The Company's solutions connect people and organizations at the right time and in the right ways, making those mission-critical connections more relevant, engaging, and actionable - turning Information to Insight. Intrado was founded in 1979 and is based in Longmont, Colorado. Advisors: Sidley , Centerview Partners |

Going Private

|

Apollo Global Management

BC Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2017-04-10 |

Alterra

Leisure Denver, Colorado www.alterramtn.co Alterra is a mountain resort and adventure company that delivers vacation and travel experiences. Intrawest owns interests in seven four-season mountain resorts geographically diversified across North America’s major ski regions with more than 11,000 skiable acres and over 1,140 acres of land available for real estate development. Intrawest also operates an adventure travel business, a heli-skiing adventure company in North America that provides helicopter accessed skiing, mountaineering, and hiking. Alterra was founded in 1976 and is based in Denver, Colorado. Advisors: Blake, Cassels & Graydon , Skadden, Arps, Slate, Meagher & Flom , Moelis & Co. , Deutsche Bank Corporate & Investment Banking , Houlihan Lokey |

Going Private

|

KSL Capital Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2017-03-14 |

Air Methods

Transportation Greenwood Village, Colorado www.airmethods.com Air Methods is a provider of air medical emergency transport services and systems throughout the US. The Company's Air Medical Services (AMS) Division provides air medical transportation services to the general population as an independent service and to hospitals and other institutions under exclusive operating agreements. Air Methods was formed in 1980 and is based in Greenwood Village, Colorado.

|

Going Private

|

American Securities

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2010-09-30 |

Gates Industrial

Manufacturing Denver, Colorado www.gates.com Gates Industrial is a manufacturer of power transmission belts and a premier global manufacturer of fluid power products. Gates Industrial was founded in 1911 and is based in Denver, Colorado. |

Going Private

|

Onex Partners

CPP Investments

|

- | ||||||

| 2010-07-28 |

Mercury Healthcare

Software Denver, Colorado www.mercuryhealthcare.com Mercury Healthcare is a technology and data analytics company that empowers healthcare organizations to engage consumers and optimize provider relationships to accelerate growth. Mercury Healthcare was founded in 1998 and is based in Denver, Colorado. Advisors: Shearman & Sterling , Citi |

Going Private

|

Vestar Capital Partners

HarbourVest Partners

Sumeru Equity Partners

|

- | ||||||

| Deal Article Deal Link | ||||||||||

| 2008-04-11 |

The TriZetto Group, Inc.

Software Denver, Colorado www.trizetto.com The TriZetto Group develops, licenses and manages software solutions for the US health insurance industry. The TriZetto Group is based in Denver, Colorado. Advisor: UBS Investment Bank |

Going Private

|

Apax

Prospect Capital Management

Blue Cross Blue Shield Association

Cambia Health Solutions, Inc.

|

- | ||||||

| 2006-12-15 |

MacDermid, Inc.

Chemicals Denver, Colorado www.macdermid.com MacDermid is a leading global provider of proprietary specialty chemicals and technical services to a wide range of diverse end use markets including electronics, metal and plastics finishing and offshore oil and gas markets. The company competes in a wide range of attractive niche markets and typically holds a #1 or #2 market position in each of its businesses. |

Going Private

|

Weston Presidio

Court Square Capital Partners

|

- | ||||||

| 2006-08-29 |

Rotonics Manufacturing, Inc.

Manufacturing Commerce City, Colorado www.rotonics.com Rotonics Manufacturing, Inc. is a rotational molding company. Rotonics Manufacturing produces a wide variety of both proprietary and custom plastic parts and products for a broad group of industries and applications, including commercial, governmental, military, agriculture, healthcare, packaging, energy and residential. |

Going Private |

Spell Capital Partners

|

- | ||||||

| Avg |

$3,705

14.8x EBITDA 5.7x REVENUE |

|||||||||

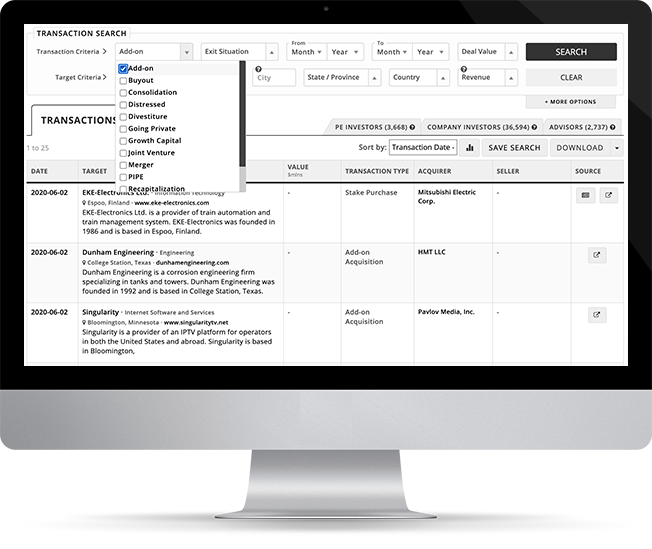

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.