| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||

|---|---|---|---|---|---|---|

| 2025-10-22 |

Integracare

Healthcare Services Toronto, Ontario www.integracare.on.ca Integracare is a private-pay home care company that offers client service and delivers home health care services, facilitated through its team of highly trained and dedicated caregivers. Integracare was founded in 1990 and is based in Toronto, Ontario. |

Secondary Buyout |

Frontline Healthcare Partners

|

Priveq Capital Funds

|

||

| Deal Article Deal Link | ||||||

| 2025-10-06 |

Sterling Brokers

Business Services Toronto, Ontario www.sterlingcapitalbrokers.com Sterling Brokers is a benefits consulting and administration firm offering group insurance, retirement services, technology-enabled platform solutions and advisory services to Canadian employers. Sterling Brokers was founded in 2014 and is headquartered in Toronto, Ontario. Advisors: Mintz Levin Cohn Ferris Glovsky and Popeo , BMO Capital Markets |

Secondary Buyout |

HGGC

|

True Wind Capital

|

||

| Deal Article Deal Link | ||||||

| 2025-06-18 |

Thermogenics

Machinery Aurora, Ontario www.thermogenicsboilers.com Thermogenics is a manufacturer of coil-tube steam and hot-water boilers and related equipment used in industrial, commercial, and institutional applications in the North American market. Thermogenics was founded in 1975 and is based in Aurora, Ontario. |

Secondary Buyout |

Morgan Stanley Capital Partners

|

Audax Private Equity

|

||

| Deal Article Deal Link | ||||||

| 2025-04-07 |

OES

Technology Hardware London, Ontario www.oes-inc.com OES is a designer, manufacturer and marketer of proprietary control systems, electronic products, scoreboards and quality assurance devices using core engineering capabilities in electrical, electronic, mechanical design, and software development. OES was founded in 1980 and is based in London, Canada. |

Secondary Buyout |

Reichmann Segal Capital Partners

|

Ardenton Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-11-27 |

Gyptech

Machinery Burlington, Ontario www.gyptech.com Gyptech is a provider of wallboard equipment and services, including the design, construction, and commissioning of complete turnkey solutions for automated gypsum board plants that convert raw gypsum into high-quality finished wallboard. Gyptech was founded in 1993 and is based in Burlington, Ontario. |

Secondary Buyout |

Fortress

|

Wynnchurch Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-11-25 |

Infra Pipe Solutions

Building Materials Mississauga, Ontario www.infrapipes.com Infra Pipe Solutions is a manufacturer of large diameter, high-density polyethylene (“HDPE”) pipe. Infra Pipe Solutions sells pipes for use in water infrastructure, mining, industrial processes, oil & gas distribution, and other applications. Infra Pipe was founded in 2018 and is based in Mississauga, Ontario. |

Secondary Buyout |

Fortress

|

Wynnchurch Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-11-22 |

Pyrotek Special Effects

Business Services Markham, Ontario www.pyrotekfx.com Pyrotek Special Effects is a provider of special effects services and solutions for the live entertainment industry with a full range of special effects offerings, creative and technical design services, permitting and logistics support worldwide, and specialized installation, setup, and tear down. Pyrotek Special Effects is based in Markham, Ontario. |

Secondary Buyout |

Gladstone Investment Corporation

|

Cobalt Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-09-24 |

Alumni Educational Solutions

Furniture Waterloo, Ontario www.alumnicf.com Alumni manufactures and distributes educational furniture for the preschool through grade twelve market. The company’s portfolio of education furniture solutions is focused on creating collaborative furniture with classrooms. It operates from three facilities in Canada, the United States, and China to serve customers across North America. Alumni Educational Solutions was founded in 2004 and is headquartered in Waterloo, Ontario. |

Secondary Buyout |

Castle Harlan

|

Ironbridge Equity Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-09-10 |

Total PowerGen Solutions

Electrical Equipment Mississauga, Ontario www.tpgs.ca Total PowerGen Solutions is a provider of commercial and industrial powergen solutions that fully complements maintenance and repair services, rentals, and equipment sales for standby, mobile, and prime power generator systems and other power quality and continuity equipment ranging from 10kW to 2,000kW and beyond. Total Power was founded in 1959 and is based in Mississauga, Ontario. |

Secondary Buyout |

Audax Private Equity

|

Trivest Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-09-10 |

Cloudpermit

Software Toronto, Ontario www.cloudpermit.com Cloudpermit is an online software solution for community development. As simple and smart software solutions, Cloudpermit empowers local governments, development communities, and the public with online land management processes. Cloudpermit is based in Toronto, Ontario. |

Secondary Buyout |

Riverside

|

Vaaka Partners

|

||

| Deal Article Deal Link | ||||||

| 2024-08-07 |

Trillium Health Care Products

Medical Products Brockville, Ontario www.trilliumhcp.com Trillium Health Care Products is a manufacturer of branded and private label personal care products (primarily bar soap), prescription drugs and over-the-counter pharmaceutical products. Trillium Health Care Products was founded in 1993 and is based in Brockville, Ontario. |

Secondary Buyout |

Avista Healthcare Partners

|

New Water Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-08-01 |

PureFacts Financial Solutions

Financial Services Toronto, Ontario www.purefacts.com PureFacts Financial Solutions is a provider of wealth management solutions for the financial services industry in Canada, USA, UK, and the Caribbean. PureFacts Financial Solutions is based in Toronto, Ontario. Advisors: Goodmans , Scotiabank - Global Banking and Markets |

Secondary Buyout |

GrowthCurve Capital

|

Canadian Business Growth Fund (CBGF)

|

||

| Deal Article Deal Link | ||||||

| 2024-07-15 |

Mevotech

Automotive Toronto, Ontario www.mevotech.com Mevotech is a provider of steering, suspension, and driveline replacement components for the automotive aftermarket. Mevotech was founded in 1982 and is based in Toronto, Ontario. Advisors: Goodmans , Osler , William Blair , Harris Williams |

Secondary Buyout |

TorQuest Partners

|

Penfund

|

||

| Deal Article Deal Link | ||||||

| 2024-06-06 |

CarltonOne Engagement

Information Technology Markham, Ontario www.carltonone.com CarltonOne Engagement is a technology company that creates B2B employee recognition, rewards, sales/channel incentive, and customer loyalty programs. CarltonOne Engagement was founded in 1989 and is based in Markham, Ontario. Advisors: Paul Hastings , Baird , Canaccord Genuity |

Secondary Buyout |

Goldman Sachs Merchant Banking

|

H.I.G. Private Equity

|

||

| Deal Article Deal Link | ||||||

| 2024-05-28 |

Athletica Sport Systems

Consumer Products Waterloo, Ontario www.athletica.com Athletica Sport Systems provides arena services, is a designer, manufacturer, and installer of dasher board systems for hockey arenas and multi-sport athletic facilities, serving the professional, semi-pro and community end-markets. Athletica Sport Systems was founded in 1996 and is based in Waterloo, Ontario. |

Secondary Buyout |

Reichmann Segal Capital Partners

|

Fulcrum Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2023-11-03 |

McKeil

Transportation Burlington, Ontario www.mckeil.com McKeil is a marine transportation company delivering turnkey solutions to customers with a wide range of transportation and project requirements. McKeil was founded in 1956 and is based in Burlington, Ontario. |

Secondary Buyout |

Astatine Investment Partners

|

TorQuest Partners

|

||

| Deal Article Deal Link | ||||||

| Avg |

$1,345

0.0x EBITDA 0.0x REVENUE |

|||||

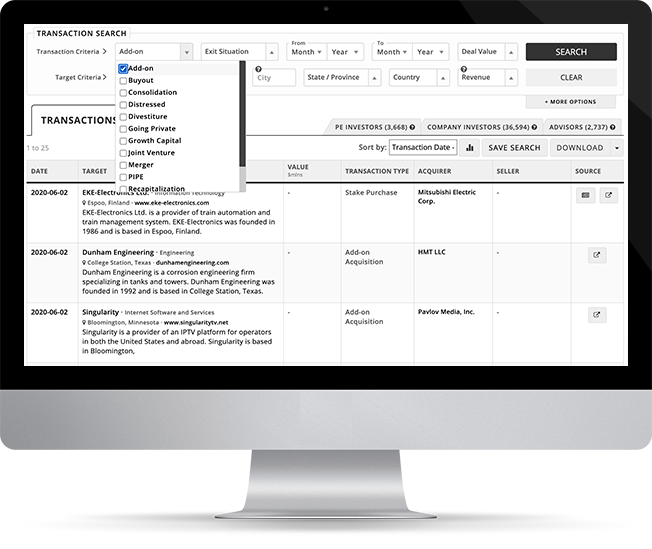

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.