| Date | Target |

Transaction Type Value: $mlns |

Acquirer | Seller | ||

|---|---|---|---|---|---|---|

| 2025-11-14 |

MEG Medical Equipment

Medical Products Raesfeld, Germany www.m-e-g.eu MEG Medical Equipment is a provider of quality medical devices for the prevention and treatment of pressure ulcers and other skin injuries caused by prolonged immobility. MEG Medical Equipment was founded in 2021 and is based in Raesfeld, Germany. |

Secondary Buyout |

Gilde Healthcare

|

Harald Quandt Industriebeteiligungen

|

||

| Deal Article Deal Link | ||||||

| 2025-10-16 |

Drive DeVilbiss Healthcare

Medical Products Port Washington, New York www.drivemedical.com Drive DeVilbiss Healthcare manufactures a complete line of medical products, including mobility products, sleep and respiratory products, beds, bariatric products, wheelchairs, sleep surfaces and pressure prevention products, self-assist products, power operated wheelchairs, rehabilitation products, patient room equipment, personal care products and electrotherapy devices. Drive DeVilbiss Healthcare was founded in 2000 and is based in Port Washington, New York. |

Secondary Buyout |

Kingswood Capital Management

|

CD&R

|

||

| Deal Article Deal Link | ||||||

| 2025-09-17 |

Isto Biologics

Medical Products Hopkinton, Massachusetts www.istobiologics.com Isto Biologics is an orthobiologics company providing advanced solutions for the spine and orthopedics markets. Isto Biologics offers an innovative portfolio of products, including InQu Bone Graft Extender & Substitute, Influx Trabecular Bone Graft, and CellPoint Concentrated Bone Marrow Aspirate System. Isto Biologics was founded in 2016 and is based in Hopkinton, Massachusetts. |

Secondary Buyout |

Keensight Capital

|

Thompson Street Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-09-17 |

Isto Biologics

Medical Products Hopkinton, Massachusetts www.istobiologics.com Isto Biologics is a regenerative MedTech company providing orthobiologic and biologic solutions for faster patient healing, including bone grafts, autologous therapies, and cell-based products used in orthopedics, spine, and sports medicine. Isto Biologics was founded in 2016 and is based in Hopkinton, Massachusetts. |

Secondary Buyout |

Keensight Capital

|

Thompson Street Capital Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-07-08 |

FotoFinder

Medical Products Bad Birnbach, Germany www.fotofinder.de FotoFinder is a provider of skin visualization technology for early skin cancer detection and aesthetics. FotoFinder was founded in 1991 and is based in Bad Birnbach, Germany. Advisor: Alvarez & Marsal |

Secondary Buyout |

GHO Capital Partners

|

EMZ Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-05-13 |

OR Technology

Medical Products Rostock, Germany www.oehm-rehbein.de Oehm und Rehbein (OR) is a provider and developer of imaging software solutions and innovative X-ray systems for human and veterinary medicine as well as industrial applications. With a wide range of portable, mobile, and stationary X-ray systems and powerful imaging software, OR enables precise diagnostics and efficient workflows in clinics, private practices, and mobile applications. OR Technology was formed in 1991 and is based in Rostock, Germany. |

Secondary Buyout |

NORD Holding

|

Rigeto

|

||

| Deal Article Deal Link | ||||||

| 2025-04-11 |

Ekoscan Integrity

Medical Products Saint-Remy, France www.ekoscanintegrity.com Ekoscan Integrity is an European end-to-end technology provider of ultrasonic, non-destructive testing, advanced solutions to effectively monitor critical infrastructures. Ekoscan Integrity was founded in 2010 and is based in Saint-Remy, France. |

Secondary Buyout |

Eurazeo PME

|

Abenex

|

||

| Deal Article Deal Link | ||||||

| 2025-03-19 |

Solmetex

Medical Products Northborough, Massachusetts www.solmetex.com Solmetex provides dental amalgam separator devices and amalgam recycling services to the dental industry. The company’s NXT Hg5 Series of amalgam separators and recycling program are used to treat dental wastewater for regulatory compliance. Solmetex was founded in 1994 and is based in Northborough, Massachusetts. Advisors: Houlihan Lokey , Baird |

Secondary Buyout |

AGIC Capital

GTCR

|

Avista Healthcare Partners

|

||

| Deal Article Deal Link | ||||||

| 2025-01-06 |

Mopec

Medical Products Oak Park, Michigan www.mopec.com Mopec is a manufacture of pathology and mortuary equipment. Its product line includes dissecting instruments, autopsy accessories, fume handling equipment, dissection tables, grossing workstations, and morgue refrigerators. Mopec was founded in 1992 and is based in Oak Park, Michigan. Advisors: Varnum , Piper Sandler & Co. |

Secondary Buyout |

Waud Capital Partners

|

Blackford Capital

Northcreek Mezzanine

|

||

| Deal Article Deal Link | ||||||

| 2024-12-10 |

Prescott’s

Medical Products Monument, Colorado www.prescottsmed.com Prescott’s is a provider and refurbisher of surgical microscopes in the United States. Prescott’s services and sells refurbished and new microscopes to hospitals and surgical centers, primarily in the neuro, ophthalmic and ENT surgical specialties. Prescott’s was founded in 1984 and is based in Monument, Colorado. Advisors: Kramer Levin Naftalis & Frankel , Houlihan Lokey , Harris Williams |

Secondary Buyout |

Morgan Stanley Capital Partners

Audax Private Debt

|

Atlantic Street Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-10-15 |

DirectMed Imaging

Medical Products Poway, California www.directmedparts.com DirectMed Imaging is a provider of medical imaging aftermarket parts, systems, and field service solutions. DirectMed Imaging was founded in 2011 and is based in Poway, California. |

Secondary Buyout |

Frazier Healthcare Partners

|

NMS Capital

Apogem Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-08-07 |

Trillium Health Care Products

Medical Products Brockville, Ontario www.trilliumhcp.com Trillium Health Care Products is a manufacturer of branded and private label personal care products (primarily bar soap), prescription drugs and over-the-counter pharmaceutical products. Trillium Health Care Products was founded in 1993 and is based in Brockville, Ontario. |

Secondary Buyout |

Avista Healthcare Partners

|

New Water Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-07-29 |

Medray

Medical Products Dublin, Ireland www.medray.ie Medray is a provider of diagnostic imaging equipment, including X-ray and CT, to customers across the healthcare, veterinary and dental markets in the UK and Ireland. Medray was founded in 1979 and is based in Dublin, Ireland. Advisors: Matheson , Regan Wall |

Secondary Buyout |

LDC

|

Erisbeg

|

||

| Deal Article Deal Link | ||||||

| 2024-07-03 |

Alinamin Pharmaceutical

Medical Products Tokyo, Japan Alinamin Pharmaceutical is an OTC and consumer healthcare company. Alinamin Pharmaceutical was founded in 2016 and is based in Tokyo, Japan. |

Secondary Buyout

|

MBK Partners

CPP Investments

|

- | ||

| Deal Article Deal Link | ||||||

| 2024-06-05 |

Sunrise Medical

Medical Products Malsch, Germany www.sunrisemedical.com Sunrise Medical is a developer, designer, manufacturer, and distributor of manual and powered wheelchairs, mobility scooters, and both standard and customized seating and positioning systems. Company key products, marketed under the Quickie, Zippie, Breezy, Sterling, JAY, Coopers and Lomax proprietary brands, are sold through a network of homecare medical product dealers or distributors in over 130 countries. Sunrise Medical was founded in 1983 and is based in Malsch, Germany. |

Secondary Buyout |

Platinum Equity

|

Nordic Capital

|

||

| Deal Article Deal Link | ||||||

| 2024-05-06 |

Healthium

Medical Products Bengaluru, India www.healthiummedtech.com Healthium is a manufacturer and marketer of surgical and medical consumables including surgical sutures, staplers, suturing needles, other wound closure products, surgical gloves, urology products, and a range of minimally invasive solutions. Healthium was formed in 1992 and is based in Bengaluru, India. Advisors: Kirkland & Ellis , Jefferies |

Secondary Buyout |

KKR

|

Apax

|

||

| Deal Article Deal Link | ||||||

| Avg |

$798

0.0x EBITDA 0.0x REVENUE |

|||||

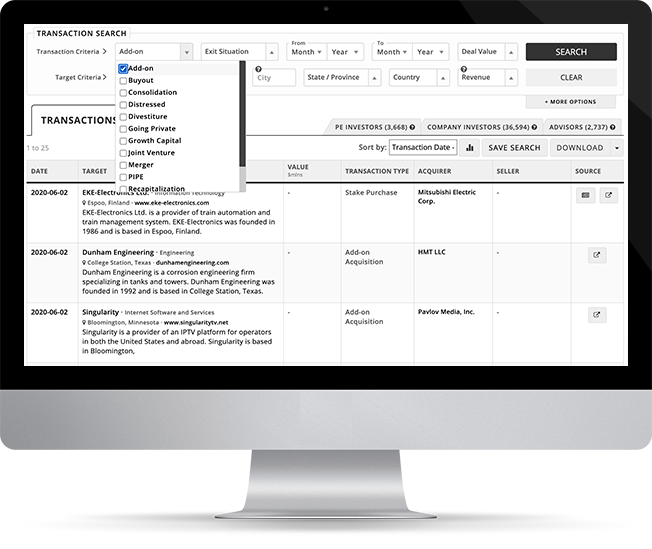

Mergr was built to simplify the process of tracking who’s buying, selling, and what deals are happening across the private markets.

Behind every transaction is an opportunity, and Mergr gives professionals access to thousands of M&A deals, along with the investors, buyers, and sellers behind them.

The platform is powerful but easy to use — so you can quickly surface relevant transactions and move from research to action.

Full access to Mergr's investor, acquirer, and transaction data starts here.