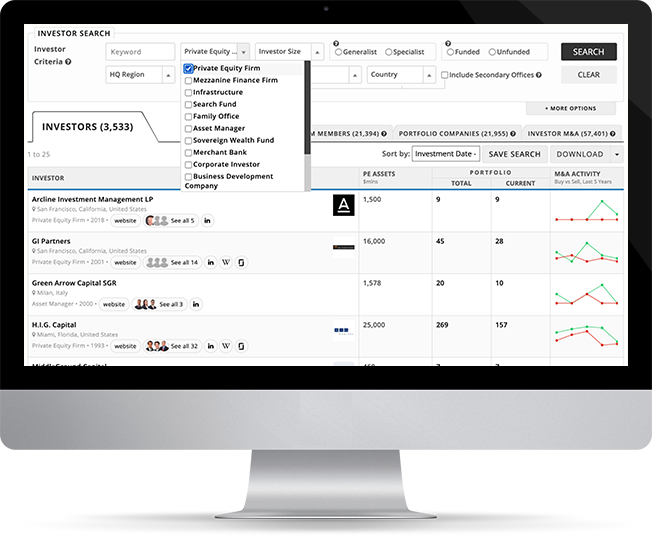

These 2,842 firms are linked to:

| 31,025 Contacts | 23,887 Portfolio Companies | 76,477 M&A Deals | 1,308 M&A Advisors |

| 31,025 Contacts | 23,887 Portfolio Companies | 76,477 M&A Deals | 1,308 M&A Advisors |

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

Blackford Capital

Grand Rapids, Michigan, United States |

- | 35 | 11 |

|

||

|

CPP Investments

Toronto, Ontario, Canada |

- | 181 | 141 |

|

||

|

EQT

Stockholm, Sweden |

272,710 | 325 | 120 |

|

||

|

IceLake Capital

Amsterdam, Netherlands |

- | 10 | 10 |

|

||

New York, New York, United States |

267,000 | 511 | 259 |

|

||

|

Mutares

Munich, Germany |

- | 58 | 25 |

|

||

| You’re viewing 16 of 2,842 investors. Sign up to view all. | ||||||

|

Renvent

Dallas, Texas, United States |

- | 1 | 1 |

|

||

|

TPG

Fort Worth, Texas, United States |

296,000 | 519 | 151 |

|

||

Austin, Texas, United States |

100,000 | 155 | 83 |

|

||

|

Permira

London, United Kingdom |

90,152 | 176 | 58 |

|

||

|

Warburg Pincus

New York, New York, United States |

83,000 | 516 | 173 |

|

||

|

Charlesbank Capital Partners

Boston, Massachusetts, United States |

6,000 | 109 | 38 |

|

||

|

Promus Capital Management

Chicago, Illinois, United States |

- | 1 | 1 |

|

||

|

Copley Equity Partners

Quincy, Massachusetts, United States |

- | 28 | 21 |

|

||

|

Rock Hill Capital

Houston, Texas, United States |

150 | 24 | 11 |

|

||

|

Sound Growth Partners

Edmonds, Washington, United States |

275 | 6 | 6 |

|

||