| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|

|---|---|---|---|---|

| Total | Current | |||

|

Levine Leichtman Capital Partners

Beverly Hills, California, United States |

12,900 | 104 | 31 |

|

|

GarMark Partners

Stamford, Connecticut, United States |

1,300 | 72 | 28 |

|

|

Greyrock Capital Group

Walnut Creek, California, United States |

350 | 66 | 11 |

|

|

Accession Capital Partners (ACP)

Vienna, Austria |

947 | 12 | 7 |

|

|

BBHCP Private Equity

New York, New York, United States |

3,000 | 20 | 9 |

|

|

Spring Capital Partners

Lutherville, Maryland, United States |

600 | 63 | 20 |

|

|

Twin Brook Capital Partners

Chicago, Illinois, United States |

22,300 | 26 | 20 |

|

|

Intermediate Capital Group (ICG)

London, United Kingdom |

74,500 | 304 | 33 |

|

|

Northstar Capital LLC

Minneapolis, Minnesota, United States |

1,700 | 162 | 38 |

|

|

Manulife Investment Management

Boston, Massachusetts, United States |

- | 28 | 6 |

|

|

Crescent Capital Group

Los Angeles, California, United States |

48,000 | 78 | 13 |

|

|

Audax Private Debt

New York, New York, United States |

5,400 | 135 | 66 |

|

|

ActoMezz

Paris, France |

801 | 43 | 29 |

|

|

Metric Capital Partners

London, United Kingdom |

- | 27 | 14 |

|

|

NMP Capital

Minneapolis, Minnesota, United States |

4,000 | 90 | 24 |

|

|

Midwest Mezzanine Funds

Chicago, Illinois, United States |

1,000 | 115 | 22 |

|

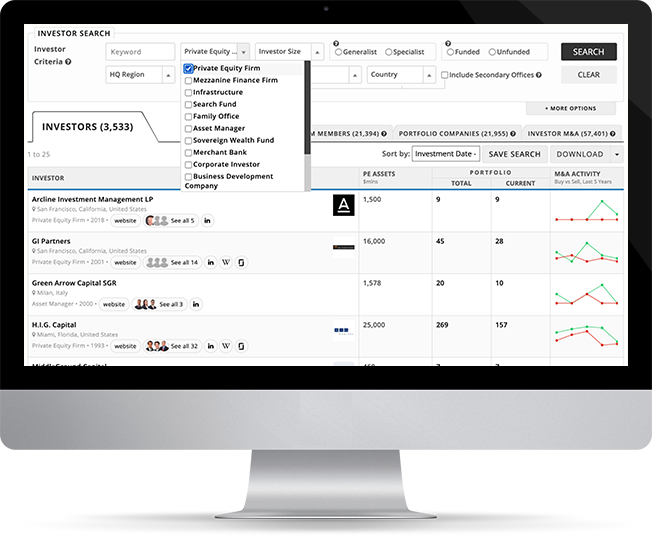

Mergr was built to make it easier to research private equity firms, their investments, and who they buy from and sell to.

Behind each firm is a strategy, and Mergr gives professionals structured access to firm profiles, portfolio companies, and investment history across the private equity landscape.

The platform is powerful but easy to use — so you can quickly identify the right firms and focus on qualified opportunities.

Full access to Mergr's investor, acquirer, and transaction data starts here.