| Name | M&A Clients |

Deal Count Last 5 Yrs - Total |

Deal Count Last 5 Yrs - YoY |

|

|---|---|---|---|---|

| Investor | Corporate | |||

|

Chicago, Illinois, United States |

255 | 817 | 1126 |

|

|

Los Angeles, California, United States |

130 | 549 | 537 |

|

|

Boston, Massachusetts, United States |

99 | 235 | 344 |

|

|

Boston, Massachusetts, United States |

66 | 356 | 316 |

|

|

Chicago, Illinois, United States |

87 | 342 | 295 |

|

|

New York, New York, United States |

55 | 227 | 251 |

|

|

Los Angeles, California, United States |

58 | 257 | 248 |

|

|

Chicago, Illinois, United States |

81 | 142 | 227 |

|

|

New York, New York, United States |

65 | 187 | 227 |

|

|

New York, New York, United States |

57 | 229 | 225 |

|

|

Chicago, Illinois, United States |

62 | 235 | 214 |

|

|

New York, New York, United States |

32 | 432 | 214 |

|

|

New York, New York, United States |

77 | 215 | 207 |

|

|

New York, New York, United States |

30 | 209 | 188 |

|

|

Washington, District of Columbia, United States |

44 | 271 | 180 |

|

|

Palo Alto, California, United States |

13 | 295 | 179 |

|

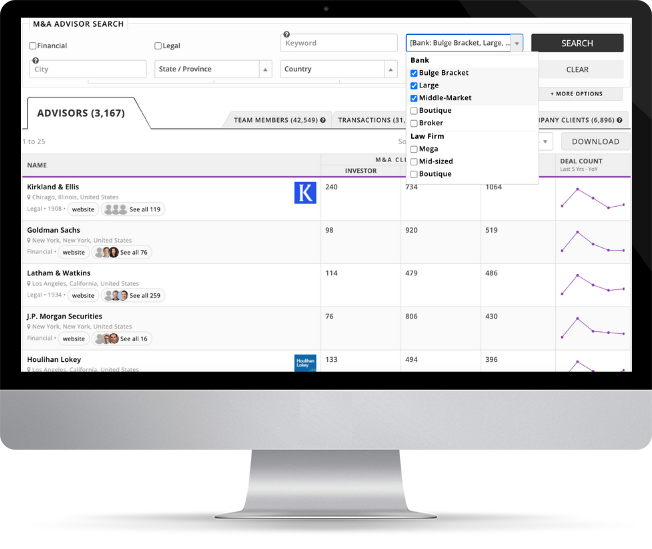

Mergr was built to help professionals track the advisors, bankers, and firms behind buy- and sell-side M&A activity.

Every deal involves decision-makers, and Mergr gives you access to advisory firm profiles, past transaction roles, and deal history — all in one place.

The platform is powerful but easy to use — so you can identify the right advisors for your next opportunity.

Full access to Mergr's investor, acquirer, and transaction data starts here.