| Name | Sector |

Revenue

$mlns |

M&A Activity | Last 5 Years | ||

|---|---|---|---|---|---|---|

| Total | Buy | Sell | ||||

|

NFP

Acquired Austin, Texas, United States website |

Insurance | 1,061 | 142 | 140 | 2 |

|

|

Confie

Acquired Huntington Beach, California, United States website |

Insurance | - | 110 | 110 | - |

|

|

IPC Healthcare, Inc.

Acquired North Hollywood, California, United States website |

Healthcare Services | 693 | 77 | 77 | - |

|

Acquired Radnor, Pennsylvania, United States website |

Chemicals | 5,314 | 75 | 74 | 1 |

|

Acquired Hopkinton, Massachusetts, United States website |

Information Technology | 24,440 | 77 | 68 | 9 |

|

Acquired New York, New York, United States website |

Internet Software and Services | 2,319 | 75 | 64 | 11 |

|

|

Gary Jonas Computing Ltd. (Jonas Software)

Acquired Markham, Ontario, Canada website |

Software | - | 58 | 58 | - |

|

Acquired Danbury, Connecticut, United States website |

Chemicals | 10,534 | 62 | 58 | 4 |

|

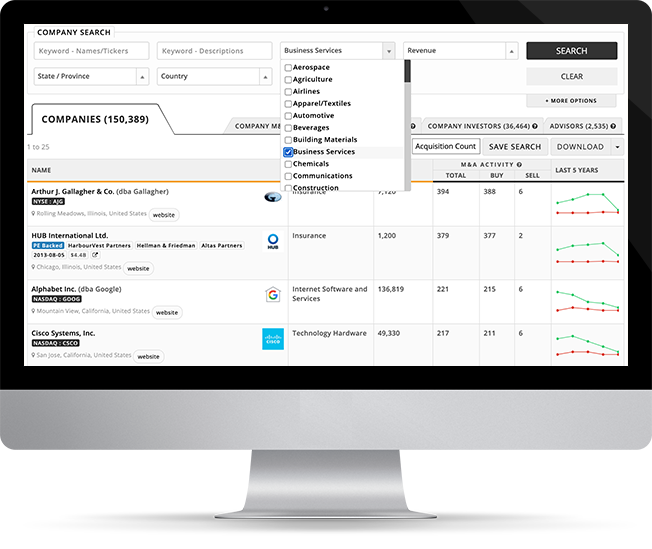

We built Mergr to save people the arduous and time-consuming process of tracking when companies are bought, sold, and who currently owns them.

Every day, new opportunities emerge around M&A and we help professionals of all types comb through transactions, investors, and corporate acquirers via an easy-to-use web database that is accessible to anyone.

Try us for 1 week free today!

No obligation. Cancel anytime.