These 821 firms are linked to:

| 11,081 Contacts | 10,187 Portfolio Companies | 38,288 M&A Deals | 974 M&A Advisors |

| 11,081 Contacts | 10,187 Portfolio Companies | 38,288 M&A Deals | 974 M&A Advisors |

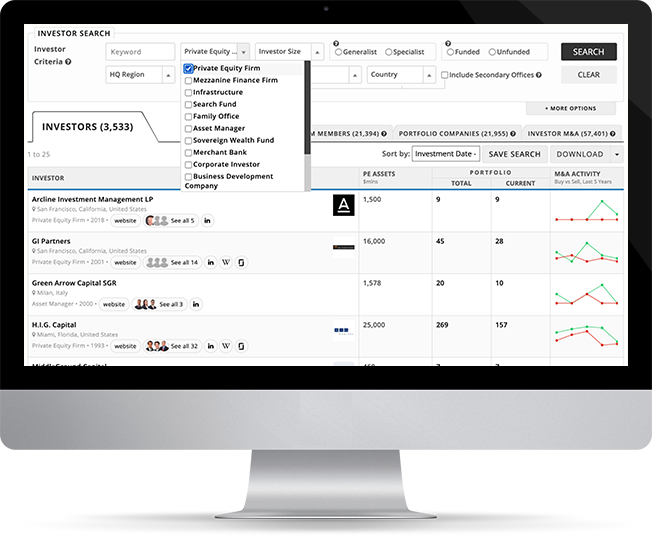

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

Fusion Capital Partners

Santa Monica, California, United States |

- | 3 | 3 |

|

||

|

Greenbriar Equity Group

Greenwich, Connecticut, United States |

10,000 | 52 | 19 |

|

||

|

HgCapital

London, United Kingdom |

70,000 | 159 | 54 |

|

||

|

PPC Enterprises

New York, New York, United States |

1,500 | 18 | 15 |

|

||

|

Riverside

New York, New York, United States |

5,000 | 299 | 66 |

|

||

|

The Blackstone Group

New York, New York, United States |

394,000 | 377 | 135 |

|

||

| You’re viewing 16 of 821 investors. Sign up to view all. | ||||||

Boca Raton, Florida, United States |

6,200 | 41 | 16 |

|

||

|

Bridgepoint

London, United Kingdom |

75,000 | 194 | 79 |

|

||

|

Madison Dearborn Partners

Chicago, Illinois, United States |

31,000 | 120 | 30 |

|

||

|

Blackford Capital

Grand Rapids, Michigan, United States |

- | 35 | 11 |

|

||

|

Fondo Italiano d'Investimento

Milan, Italy |

3,381 | 22 | 17 |

|

||

|

EQT

Stockholm, Sweden |

272,710 | 325 | 120 |

|

||

New York, New York, United States |

267,000 | 511 | 259 |

|

||

|

Permira

London, United Kingdom |

90,152 | 176 | 58 |

|

||

|

Warburg Pincus

New York, New York, United States |

83,000 | 516 | 173 |

|

||

|

Charlesbank Capital Partners

Boston, Massachusetts, United States |

6,000 | 110 | 39 |

|

||