These 460 firms are linked to:

| 6,035 Contacts | 5,617 Portfolio Companies | 21,143 M&A Deals | 682 M&A Advisors |

| 6,035 Contacts | 5,617 Portfolio Companies | 21,143 M&A Deals | 682 M&A Advisors |

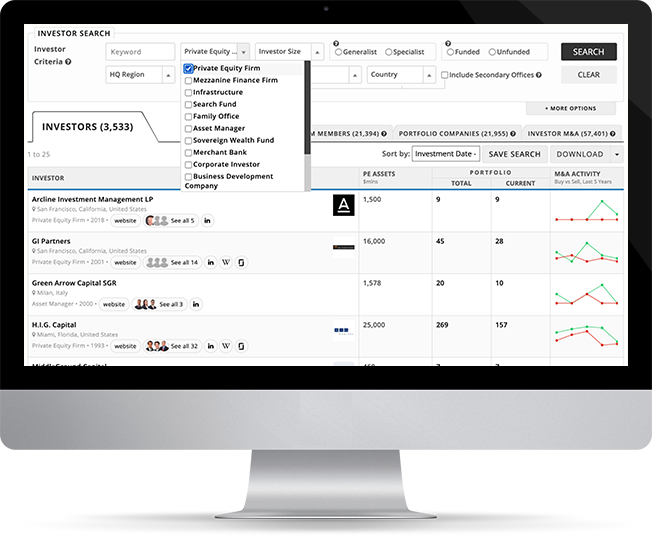

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

Fondo Italiano d'Investimento

Milan, Italy |

3,381 | 22 | 17 |

|

||

|

Sandbrook Capital

Stamford, Connecticut, United States |

4,000 | 6 | 6 |

|

||

|

Bertram Capital

Foster City, California, United States |

3,000 | 48 | 19 |

|

||

|

CDIB Capital Group

Hong Kong, China |

2,670 | 21 | 6 |

|

||

|

Equity Group Investments

Chicago, Illinois, United States |

- | 25 | 17 |

|

||

|

HBM Partners

Zug, Switzerland |

2,100 | 70 | 26 |

|

||

| You’re viewing 16 of 460 investors. Sign up to view all. | ||||||

|

SK Capital Partners

New York, New York, United States |

4,860 | 46 | 28 |

|

||

|

Wise Equity

Milan, Italy |

1,494 | 44 | 14 |

|

||

|

Tailwater Capital

Dallas, Texas, United States |

4,400 | 29 | 17 |

|

||

|

Great Point Partners

Greenwich, Connecticut, United States |

1,700 | 38 | 16 |

|

||

|

Solum Partners

Boston, Massachusetts, United States |

1,900 | 10 | 10 |

|

||

|

Stellus Capital Management

Houston, Texas, United States |

3,400 | 89 | 80 |

|

||

|

Level Equity

New York, New York, United States |

3,000 | 96 | 63 |

|

||

|

OceanSound Partners

New York, New York, United States |

4,500 | 12 | 11 |

|

||

|

Tiger Infrastructure Partners

New York, New York, United States |

3,200 | 27 | 21 |

|

||

|

Linden Capital Partners

Chicago, Illinois, United States |

3,000 | 51 | 24 |

|

||