These 13 firms are linked to:

| 129 Contacts | 199 Portfolio Companies | 652 M&A Deals | 24 M&A Advisors |

| 129 Contacts | 199 Portfolio Companies | 652 M&A Deals | 24 M&A Advisors |

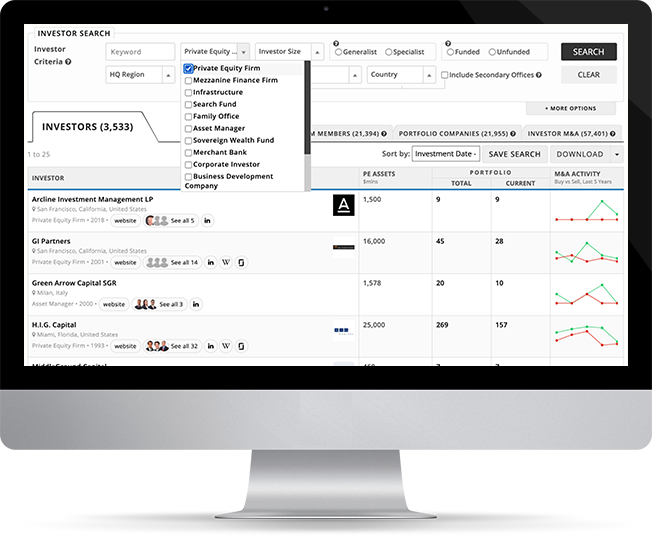

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

True North Co.

Mumbai, India |

3,000 | 45 | 16 |

|

||

|

Shikoku Alliance Capital

Matsuyama City, Japan |

91 | 18 | 18 |

|

||

|

Caledonia Private Capital

London, United Kingdom |

1,341 | 6 | 5 |

|

||

|

Invest

Linz, Austria |

225 | 65 | 45 |

|

||

|

White Deer Energy

Houston, Texas, United States |

3,000 | 35 | 13 |

|

||

|

Lime Rock Partners

Westport, Connecticut, United States |

10,400 | 93 | 12 |

|

||

| You’re viewing 13 of 13 investors. Sign up to view all. | ||||||

|

Ratos

Stockholm, Sweden |

- | 31 | 18 |

|

||

|

Rubicon Partners

London, United Kingdom |

- | 34 | 8 |

|

||

|

WestBridge Capital Partners

Bangalore, India |

7,500 | 61 | 38 |

|

||

|

SDC Capital Partners

New York, New York, United States |

400 | 9 | 7 |

|

||

|

Calico Group

Casper, Wyoming, United States |

- | 3 | 2 |

|

||

|

Suma Capital

Barcelona, Spain |

- | 20 | 12 |

|

||

|

Maj Invest Equity

Copenhagen, Denmark |

665 | 81 | 8 |

|

||