These 6 firms are linked to:

| 54 Contacts | 94 Portfolio Companies | 349 M&A Deals |

| 54 Contacts | 94 Portfolio Companies | 349 M&A Deals |

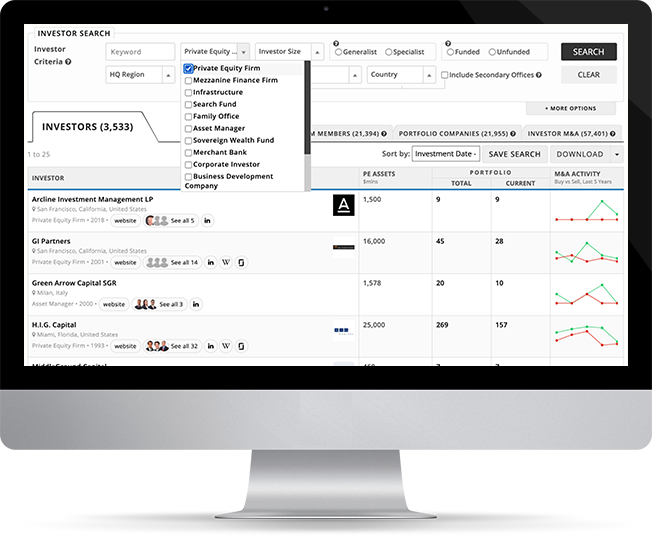

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

GarMark Partners

Stamford, Connecticut, United States |

1,300 | 72 | 28 |

|

||

|

Brookside Capital Partners

Stamford, Connecticut, United States |

1,200 | 70 | 41 |

|

||

|

Balance Point Capital Partners LP

Westport, Connecticut, United States |

1,700 | 47 | 24 |

|

||

|

Southfield Mezzanine Capital

Greenwich, Connecticut, United States |

- | 16 | 8 |

|

||

|

New Canaan Funding LLC

New Canaan, Connecticut, United States |

238 | 44 | - |

|

||

|

Arrowhead Investment Management

Greenwich, Connecticut, United States |

- | 26 | - |

|

||

| You’re viewing 6 of 6 investors. Sign up to view all. | ||||||