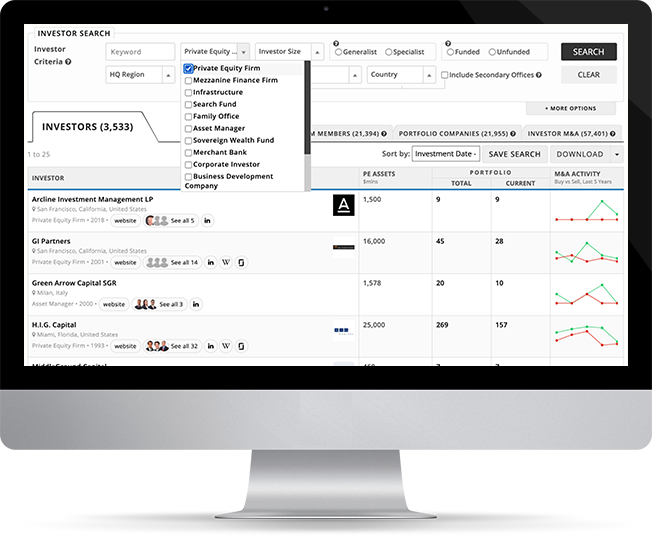

These 24 firms are linked to:

| 120 Contacts | 84 Portfolio Companies | 331 M&A Deals | 10 M&A Advisors |

| 120 Contacts | 84 Portfolio Companies | 331 M&A Deals | 10 M&A Advisors |

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

GCP Capital Partners

New York, New York, United States |

1,200 | 49 | 11 |

|

||

|

Raine

New York, New York, United States |

2,500 | 19 | 7 |

|

||

|

American Discovery Capital

Los Angeles, California, United States |

- | 6 | 4 |

|

||

|

Harvey & Company

Newport Beach, California, United States |

- | 72 | 29 |

|

||

|

CapitalSG

Singapore, Singapore |

- | 1 | 1 |

|

||

|

Global Capital

Johannesburg, South Africa |

- | 38 | 7 |

|

||

| You’re viewing 16 of 24 investors. Sign up to view all. | ||||||

|

RGF Capital

Naples, Florida, United States |

- | 2 | 1 |

|

||

|

RBB Management AG

Bautzen, Germany |

- | 20 | 18 |

|

||

|

Valedor Partners

Houston, Texas, United States |

- | 6 | 5 |

|

||

|

FirePower Equity

Toronto, Ontario, Canada |

- | 7 | 6 |

|

||

|

Liberty Street Capital

Atlanta, Georgia, United States |

- | 4 | 4 |

|

||

|

Plenary Partners

Chicago, Illinois, United States |

- | 2 | 2 |

|

||

|

Alternative Capital Group

Montréal, Quebec, Canada |

- | 1 | 1 |

|

||

|

Olympia Capital Partners

Amsterdam, Netherlands |

- | 2 | 2 |

|

||

|

JHP Enterprises

Norwalk, Connecticut, United States |

- | 5 | 4 |

|

||

|

Broadstream Capital Partners

Los Angeles, California, United States |

- | 1 | 1 |

|

||