These 66 firms are linked to:

| 642 Contacts | 1,166 Portfolio Companies | 2,993 M&A Deals | 113 M&A Advisors |

| 642 Contacts | 1,166 Portfolio Companies | 2,993 M&A Deals | 113 M&A Advisors |

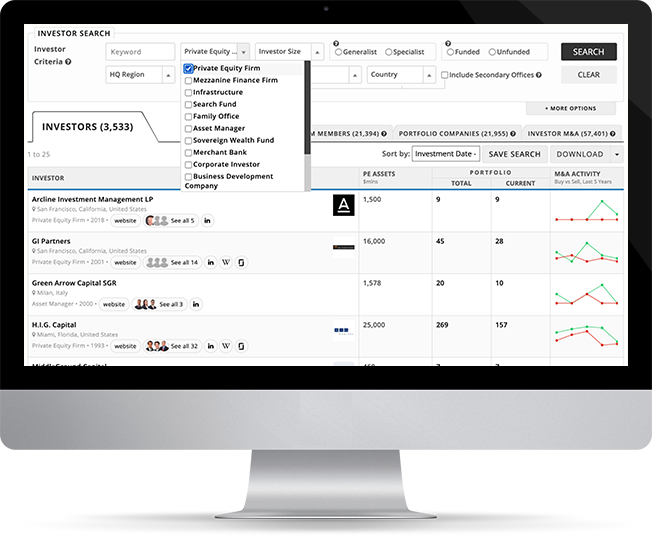

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

Advantage Capital Partners

New Orleans, Louisiana, United States |

2,600 | 372 | 163 |

|

||

|

Stripes

New York, New York, United States |

7,000 | 49 | 23 |

|

||

|

Tide Rock Holdings

Cardiff, California, United States |

- | 21 | 17 |

|

||

|

Five V Capital

Darlinghurst, Australia |

391 | 26 | 21 |

|

||

|

L Catterton Partners

Greenwich, Connecticut, United States |

37,000 | 229 | 105 |

|

||

|

Ironwood Capital

Avon, Connecticut, United States |

1,000 | 136 | 43 |

|

||

| You’re viewing 16 of 66 investors. Sign up to view all. | ||||||

|

Sherpa Capital

Madrid, Spain |

282 | 29 | 18 |

|

||

|

Silas Capital

New York, New York, United States |

- | 22 | 11 |

|

||

|

BGF

London, United Kingdom |

3,849 | 374 | 234 |

|

||

|

New Value Capital

Park City, Utah, United States |

- | 5 | 3 |

|

||

|

Canadian Shield Capital

Toronto, Ontario, Canada |

- | 1 | 1 |

|

||

|

Growth Capital Partners

London, United Kingdom |

385 | 47 | 15 |

|

||

|

Morgan Stanley Expansion Capital

New York, New York, United States |

- | 48 | 36 |

|

||

|

Icos Capital

Rotterdam, Netherlands |

- | 17 | 10 |

|

||

|

Panoramic Growth Equity

London, United Kingdom |

154 | 28 | 15 |

|

||

|

Comitis Capital

Frankfurt, Germany |

- | 2 | 2 |

|

||