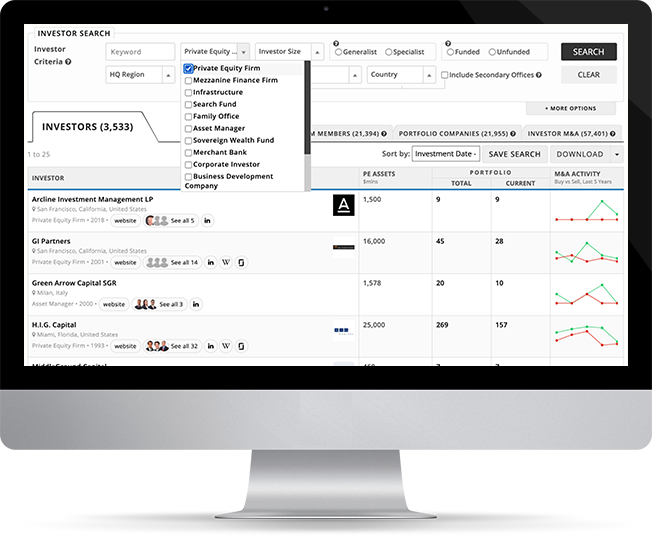

These 16 firms are linked to:

| 481 Contacts | 617 Portfolio Companies | 1,857 M&A Deals | 143 M&A Advisors |

| 481 Contacts | 617 Portfolio Companies | 1,857 M&A Deals | 143 M&A Advisors |

| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|||

|---|---|---|---|---|---|---|

| Total | Current | |||||

|

Apollo Global Management

New York, New York, United States |

72,000 | 157 | 73 |

|

||

|

Ara Partners

Houston, Texas, United States |

- | 28 | 25 |

|

||

|

Investcorp

Manama, Bahrain |

53,000 | 208 | 67 |

|

||

|

AURELIUS Equity Opportunities

Grünwald, Germany |

- | 72 | 33 |

|

||

|

Tikehau Capital

Paris, France |

8,790 | 55 | 44 |

|

||

|

Capitala Group

Charlotte, North Carolina, United States |

2,200 | 129 | 36 |

|

||

| You’re viewing 16 of 16 investors. Sign up to view all. | ||||||

|

Maven Capital Partners

Glasgow, United Kingdom |

1,170 | 222 | 107 |

|

||

|

Kayne Anderson Capital Advisors

Los Angeles, California, United States |

36,000 | 185 | 37 |

|

||

|

Credit Mutuel Equity

Paris, France |

4,508 | 196 | 148 |

|

||

|

PAG

Hong Kong, China |

55,000 | 27 | 23 |

|

||

|

Peterson Partners

Salt Lake City, Utah, United States |

350 | 68 | 13 |

|

||

|

Star Capital

Milan, Italy |

452 | 25 | 11 |

|

||

|

First Sentier Investors

Barangaroo, Australia |

- | 4 | 3 |

|

||

|

Värde Partners

Minneapolis, Minnesota, United States |

13,000 | 18 | 7 |

|

||

|

Capitalworks Investment Partners

Sandton, South Africa |

1,000 | 9 | 1 |

|

||

|

Aozora Investment Management

Tokyo, Japan |

3,961 | - | - |

|

||