| Name | M&A Clients |

Deal Count Last 5 Yrs - Total |

Deal Count Last 5 Yrs - YoY |

|

|---|---|---|---|---|

| Investor | Corporate | |||

|

San Francisco, California, United States |

29 | 103 | 89 |

|

|

New York, New York, United States |

30 | 117 | 88 |

|

|

Columbia, South Carolina, United States |

6 | 66 | 70 |

|

|

Detroit, Michigan, United States |

11 | 65 | 61 |

|

|

Boston, Massachusetts, United States |

20 | 50 | 49 |

|

|

Cincinnati, Ohio, United States |

5 | 40 | 46 |

|

|

Chicago, Illinois, United States |

8 | 54 | 40 |

|

|

Cleveland, Ohio, United States |

14 | 30 | 38 |

|

|

Minneapolis, Minnesota, United States |

10 | 38 | 37 |

|

|

Chicago, Illinois, United States |

10 | 40 | 35 |

|

|

Redwood City, California, United States |

1 | 65 | 34 |

|

|

Stamford, Connecticut, United States |

6 | 26 | 30 |

|

|

Denver, Colorado, United States |

4 | 38 | 28 |

|

|

Washington, District of Columbia, United States |

4 | 51 | 27 |

|

|

Atlanta, Georgia, United States |

7 | 32 | 26 |

|

|

Atlanta, Georgia, United States |

1 | 47 | 25 |

|

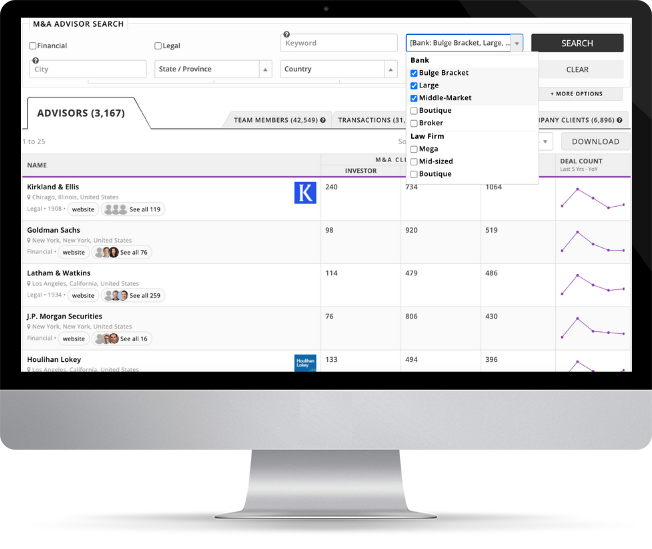

Mergr was built to help professionals track the advisors, bankers, and firms behind buy- and sell-side M&A activity.

Every deal involves decision-makers, and Mergr gives you access to advisory firm profiles, past transaction roles, and deal history — all in one place.

The platform is powerful but easy to use — so you can identify the right advisors for your next opportunity.

Full access to Mergr's investor, acquirer, and transaction data starts here.