| Name | Sector |

Revenue

$mlns |

M&A Activity | Last 5 Years | ||

|---|---|---|---|---|---|---|

| Total | Buy | Sell | ||||

|

Unilever

Public London, United Kingdom website |

Consumer Products | 57,161 | 68 | 45 | 23 |

|

London Stock Exchange : PSON London, United Kingdom website |

Publishing | 5,656 | 45 | 29 | 16 |

|

|

Essentra

London Stock Exchange : ESNT Oxford, United Kingdom website |

Plastics | 486 | 28 | 21 | 7 |

|

NYSE : PNR London, United Kingdom website |

Diversified | 4,105 | 22 | 17 | 5 |

|

|

Rio Tinto

NYSE : RIO London, United Kingdom website |

Metals/Mining | 54,041 | 23 | 9 | 14 |

|

|

Anglo American

London Stock Exchange : AAL London, United Kingdom website |

Metals/Mining | 30,652 | 6 | 2 | 4 |

|

|

Thompson Heath & Bond

Acquired London, United Kingdom website |

Insurance | - | 2 | 1 | 1 |

|

|

Kenyon Fraser Ltd.

Private Liverpool, United Kingdom website |

Media | - | 2 | 1 | 1 |

|

|

Fiberweb plc

Acquired London, United Kingdom website |

Manufacturing | - | 1 | - | 1 |

|

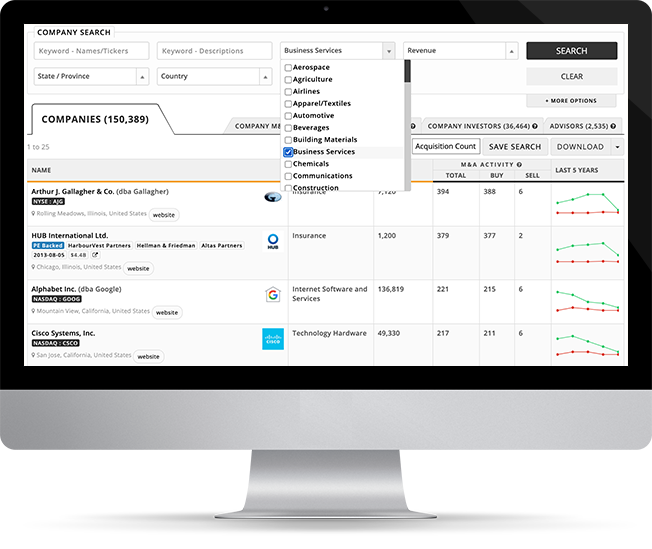

We built Mergr to save people the arduous and time-consuming process of tracking when companies are bought, sold, and who currently owns them.

Every day, new opportunities emerge around M&A and we help professionals of all types comb through transactions, investors, and corporate acquirers via an easy-to-use web database that is accessible to anyone.

Try us for 1 week free today!

No obligation. Cancel anytime.